Home

Home

Back

Back

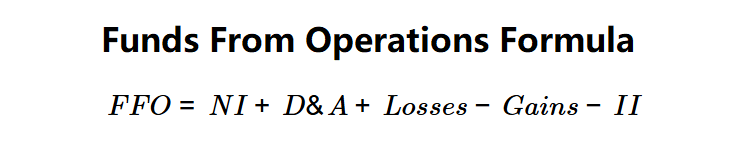

Definition: This calculator computes the funds from operations (\( FFO \)), a metric used primarily for Real Estate Investment Trusts (REITs) to measure cash generated from core operations, adjusted for non-cash items and certain revenues.

Purpose: Helps investors and analysts evaluate the financial health and cash flow sustainability of REITs, providing a more accurate picture than net income alone.

The calculator follows a five-step process to compute FFO:

Formula:

Steps:

Note: The formula used here follows the example provided, subtracting interest income. Some definitions (e.g., NAREIT) may exclude interest income differently; this calculator adheres to the given specification.

Calculating FFO is crucial for:

Example 1 (REIT Alpha): \( NI = \$500,000 \), \( D\&A = \$150,000 \), \( Gains = \$125,000 \), \( Losses = \$80,000 \), \( II = \$75,000 \):

An FFO of $530,000 indicates strong operational cash flow for REIT Alpha.

Example 2: \( NI = \$1,000,000 \), \( D\&A = \$200,000 \), \( Gains = \$300,000 \), \( Losses = \$50,000 \), \( II = \$100,000 \):

An FFO of $850,000 reflects solid cash flow after adjustments.

Example 3: \( NI = \$300,000 \), \( D\&A = \$80,000 \), \( Gains = \$50,000 \), \( Losses = \$20,000 \), \( II = \$30,000 \):

An FFO of $320,000 suggests moderate operational cash generation.

Q: What is funds from operations?

A: Funds from operations (\( FFO \)) is a metric used by REITs to measure cash generated from core operations, adjusted for non-cash items and certain revenues.

Q: Why adjust for gains and losses from property sales?

A: These adjustments exclude one-time gains or losses to focus on recurring operational cash flow.

Q: Can FFO be negative?

A: Yes, if net income and losses are insufficient to offset depreciation, gains, and interest income, \( FFO \) can be negative.