Home

Home

Back

Back

Definition: Expected Utility is a concept in economics and decision theory that measures the anticipated benefit or satisfaction from a decision, considering the probabilities and outcomes of different events.

Purpose: This calculation helps in evaluating decisions under uncertainty by quantifying the expected satisfaction derived from monetary outcomes, adjusted for risk preferences.

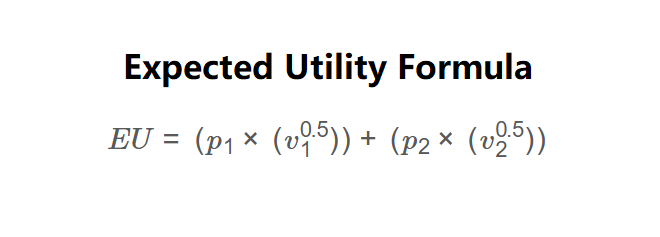

The calculator uses the following formula for Expected Utility, as shown in the image above:

\[ EU = (p_1 \times (v_1^{0.5})) + (p_2 \times (v_2^{0.5})) \]

Where:

Steps:

Calculating Expected Utility is essential for:

Example 1: Calculate the Expected Utility of two investments

Example 2: Calculate the Expected Utility of a lottery

Q: Why use the square root in the utility function?

A: The square root reflects diminishing marginal utility, meaning additional money provides less additional satisfaction as wealth increases.

Q: When would I need to calculate expected utility?

A: When making decisions under uncertainty, such as choosing between investments or evaluating risky options.

Q: What does a higher expected utility mean?

A: A higher expected utility indicates indicates a more desirable option, considering both the outcomes and their probabilities.

Q: How does this differ from expected value?

A: Expected Value calculates the average monetary outcome, while Expected Utility adjusts for risk preferences using a utility function.