Home

Home

Back

Back

Definition: The Equivalent Interest Rate is the interest rate that would produce the same effective annual yield when compounded at a different frequency than the original rate.

Purpose: This calculation allows for comparison of interest rates with different compounding periods by converting them to equivalent rates with the same compounding frequency.

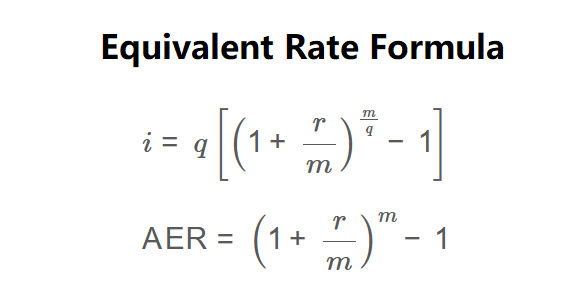

The calculator uses the following formula for Equivalent Interest Rate:

\[ i = q \left[ \left( 1 + \frac{r}{m} \right)^{\frac{m}{q}} - 1 \right] \]

For Effective Annual Rate (AER), the formula is:

\[ \text{AER} = \left( 1 + \frac{r}{m} \right)^m - 1 \]

Where:

Steps:

Calculating equivalent rates and AER is essential for:

Example 1: Convert 8% compounded quarterly to an equivalent rate compounded monthly

Example 2: Convert 5% compounded semi-annually to an equivalent rate compounded daily

Q: Why does the equivalent rate change with different compounding frequencies?

A: The rate adjusts to maintain the same effective annual yield despite the change in compounding frequency.

Q: When would I need to calculate equivalent rates?

A: When comparing financial products with different payment schedules or when changing the compounding frequency of an investment.

Q: Does more frequent compounding always result in a lower equivalent rate?

A: Yes, because the same effective yield can be achieved with a lower nominal rate when compounding more frequently.

Q: How is this different from effective annual rate?

A: EAR (or AER) converts to annual compounding, while equivalent rate can convert to any desired compounding frequency.