1. What is Enterprise Value Calculator?

Definition: This calculator computes the enterprise value, the total value of a company including debt and cash.

Purpose: Helps investors and analysts assess the true market value of a company, especially in acquisitions.

2. How Does the Calculator Work?

The calculator uses the formula:

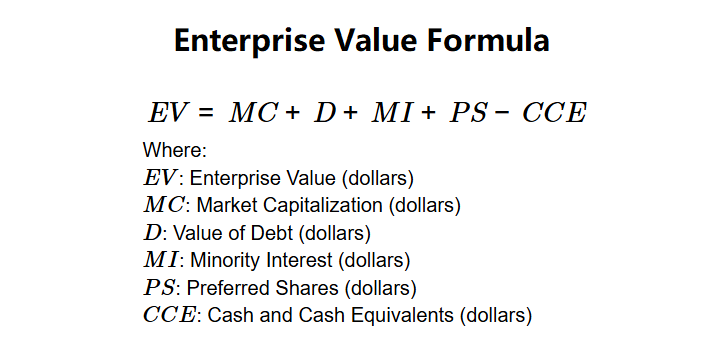

Enterprise Value Formula:

\( EV = MC + D + MI + PS - CCE \)

Where:

- \( EV \): Enterprise Value (dollars)

- \( MC \): Market Capitalization (dollars)

- \( D \): Value of Debt (dollars)

- \( MI \): Minority Interest (dollars)

- \( PS \): Preferred Shares (dollars)

- \( CCE \): Cash and Cash Equivalents (dollars)

Steps:

- Enter market cap, debt, minority interest, preferred shares, and cash equivalents.

- Calculate enterprise value by summing and subtracting as per the formula.

- Display with 2 decimal places.

3. Importance of Enterprise Value

Calculating enterprise value is crucial for:

- Valuation: Provides a comprehensive view beyond market cap, including debt and cash.

- Acquisition Analysis: Reflects the actual cost of buying a company, accounting for liabilities.

- Investment Decisions: Helps compare companies with different capital structures.

4. Using the Calculator

Example 1: MC = $156.825M, D = $143.5M, MI = $0, PS = $0, CCE = $50M:

- Market Cap: $156.825M

- Value of Debt: $143.5M

- Minority Interest: $0

- Preferred Shares: $0

- Cash Equivalents: $50M

- EV: \( 156.825M + 143.5M + 0 + 0 - 50M = 250.325M \) dollars

- Result: \( 250.32 \) dollars

Example 2: MC = $400,000, D = $20,000, MI = $5,000, PS = $10,000, CCE = $0:

- Market Cap: $400,000

- Value of Debt: $20,000

- Minority Interest: $5,000

- Preferred Shares: $10,000

- Cash Equivalents: $0

- EV: \( 400,000 + 20,000 + 5,000 + 10,000 - 0 = 435,000 \) dollars

- Result: \( 435,000.00 \) dollars

5. Frequently Asked Questions (FAQ)

Q: Why subtract cash equivalents?

A: Cash reduces the net acquisition cost, as it can be used to pay off debt.

Q: How is market cap determined?

A: Multiply the number of outstanding shares by the current stock price.

Q: What if EV is negative?

A: A negative EV may indicate high cash reserves, potentially a buying opportunity, but requires further analysis.

Enterprise Value Calculator© - All Rights Reserved 2025

Home

Home

Back

Back