1. What is the Effective Duration Calculator?

Definition: This calculator computes the effective duration (\( ED \)), a measure of a bond’s price sensitivity to changes in interest rates, accounting for changes in cash flows due to embedded options or yield shifts.

Purpose: Helps investors and portfolio managers assess interest rate risk, enabling better bond selection and risk management.

2. How Does the Calculator Work?

The calculator follows a four-step process to compute the effective duration:

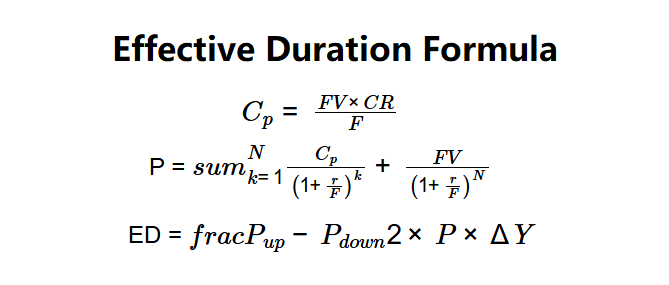

Formulas:

\( C_p = \frac{FV \times CR}{F} \)

P = \(sum_{k=1}^{N} \frac{C_p}{\left(1 + \frac{r}{F}\right)^k} + \frac{FV}{\left(1 + \frac{r}{F}\right)^N}\)

Where \( r \) is \( YTM \), \( YTM - \Delta Y \), or \( YTM + \Delta Y \), and \( N = T \times F \).

ED = \(frac{P_{up} - P_{down}}{2 \times P \times \Delta Y}\)

Where:

- \( ED \): Effective Duration (years)

- \( C_p \): Coupon per Period (dollars)

- \( P \): Bond Price at \( YTM \) (dollars)

- \( P_{up} \): Bond Price at \( YTM - \Delta Y \) (dollars)

- \( P_{down} \): Bond Price at \( YTM + \Delta Y \) (dollars)

- \( FV \): Face Value (dollars)

- \( CR \): Annual Coupon Rate (decimal)

- \( F \): Coupon Frequency (per year)

- \( T \): Years to Maturity

- \( YTM \): Yield to Maturity (decimal)

- \( \Delta Y \): Yield Differential (decimal)

- \( N \): Total Periods (\( T \times F \))

Steps:

- Step 1: Calculate coupon per period. Compute \( C_p = \frac{FV \times CR}{F} \).

- Step 2: Calculate bond price. Compute \( P \) using \( YTM \).

- Step 3: Calculate upwards and downwards bond prices. Compute \( P_{up} \) at \( YTM - \Delta Y \) and \( P_{down} \) at \( YTM + \Delta Y \).

- Step 4: Calculate effective duration. Compute \( ED = \frac{P_{up} - P_{down}}{2 \times P \times \Delta Y} \).

3. Importance of Effective Duration Calculation

Calculating effective duration is crucial for:

- Interest Rate Risk: Measures how a bond’s price changes with a 1% yield shift, critical for managing portfolio risk.

- Bond Selection: Helps investors choose bonds with desired sensitivity to rate changes.

- Portfolio Management: Enables balancing of interest rate exposure across bond holdings.

4. Using the Calculator

Example (Bond Alpha): \( FV = \$1,000 \), \( CR = 5\% \), \( F = 1 \), \( T = 10 \), \( YTM = 8\% \), \( \Delta Y = 1\% \):

- Step 1: \( C_p = \frac{1,000 \times 0.05}{1} = \$50 \).

- Step 2: \( P = \sum_{k=1}^{10} \frac{50}{(1 + 0.08)^k} + \frac{1,000}{(1 + 0.08)^{10}} = \$798.70 \).

- Step 3:

- \( P_{up} = \sum_{k=1}^{10} \frac{50}{(1 + 0.07)^k} + \frac{1,000}{(1 + 0.07)^{10}} = \$859.53 \) (at \( YTM = 7\% \)).

- \( P_{down} = \sum_{k=1}^{10} \frac{50}{(1 + 0.09)^k} + \frac{1,000}{(1 + 0.09)^{10}} = \$743.29 \) (at \( YTM = 9\% \)).

- Step 4: \( ED = \frac{859.53 - 743.29}{2 \times 798.70 \times 0.01} = \frac{116.24}{15.974} \approx 7.277 \).

- Results: \( C_p = \$50 \), \( P = \$798.70 \), \( P_{up} = \$859.53 \), \( P_{down} = \$743.29 \), \( ED = 7.277 \) years.

An effective duration of 7.277 years indicates a 1% yield increase reduces the bond price by approximately 7.277%.

Example 2: \( FV = \$1,000 \), \( CR = 6\% \), \( F = 2 \), \( T = 5 \), \( YTM = 7\% \), \( \Delta Y = 0.5\% \):

- Step 1: \( C_p = \frac{1,000 \times 0.06}{2} = \$30 \).

- Step 2: \( P = \sum_{k=1}^{10} \frac{30}{(1 + \frac{0.07}{2})^k} + \frac{1,000}{(1 + \frac{0.07}{2})^{10}} \approx \$957.35 \).

- Step 3:

- \( P_{up} = \sum_{k=1}^{10} \frac{30}{(1 + \frac{0.065}{2})^k} + \frac{1,000}{(1 + \frac{0.065}{2})^{10}} \approx \$981.22 \) (at \( YTM = 6.5\% \)).

- \( P_{down} = \sum_{k=1}^{10} \frac{30}{(1 + \frac{0.075}{2})^k} + \frac{1,000}{(1 + \frac{0.075}{2})^{10}} \approx \$934.02 \) (at \( YTM = 7.5\% \)).

- Step 4: \( ED = \frac{981.22 - 934.02}{2 \times 957.35 \times 0.005} \approx \frac{47.20}{9.5735} \approx 4.931 \).

- Results: \( C_p = \$30 \), \( P \approx \$957.35 \), \( P_{up} \approx \$981.22 \), \( P_{down} \approx \$934.02 \), \( ED \approx 4.931 \) years.

An effective duration of 4.931 years suggests moderate sensitivity to yield changes.

Example 3: \( FV = \$1,000 \), \( CR = 4\% \), \( F = 1 \), \( T = 15 \), \( YTM = 3\% \), \( \Delta Y = 1\% \):

- Step 1: \( C_p = \frac{1,000 \times 0.04}{1} = \$40 \).

- Step 2: \( P = \sum_{k=1}^{15} \frac{40}{(1 + 0.03)^k} + \frac{1,000}{(1 + 0.03)^{15}} \approx \$1,103.48 \).

- Step 3:

- \( P_{up} = \sum_{k=1}^{15} \frac{40}{(1 + 0.02)^k} + \frac{1,000}{(1 + 0.02)^{15}} \approx \$1,172.07 \) (at \( YTM = 2\% \)).

- \( P_{down} = \sum_{k=1}^{15} \frac{40}{(1 + 0.04)^k} + \frac{1,000}{(1 + 0.04)^{15}} \approx \$1,040.58 \) (at \( YTM = 4\% \)).

- Step 4: \( ED = \frac{1,172.07 - 1,040.58}{2 \times 1,103.48 \times 0.01} \approx \frac{131.49}{22.0696} \approx 5.957 \).

- Results: \( C_p = \$40 \), \( P \approx \$1,103.48 \), \( P_{up} \approx \$1,172.07 \), \( P_{down} \approx \$1,040.58 \), \( ED \approx 5.957 \) years.

An effective duration of 5.957 years indicates a 1% yield change impacts the bond price by about 5.957%.

5. Frequently Asked Questions (FAQ)

Q: How does effective duration differ from Macaulay duration?

A: Effective duration accounts for changes in cash flows due to yield shifts (e.g., embedded options), while Macaulay duration assumes fixed cash flows.

Q: Why use a yield differential?

A: The yield differential (\( \Delta Y \)) simulates small yield changes to estimate price sensitivity, ensuring accurate duration measurement.

Q: Can effective duration be negative?

A: Yes, for bonds with complex features (e.g., certain mortgage-backed securities), but rare for standard bonds like Bond Alpha.

Effective Duration Calculator© - All Rights Reserved 2025

Home

Home

Back

Back