Home

Home

Back

Back

Definition: This calculator computes the economic profit (\( EP \)), which measures a company's total profit after accounting for both explicit costs (out-of-pocket expenses) and implicit costs (opportunity costs), providing a true economic return.

Purpose: Helps businesses, economists, and investors assess the overall profitability of a venture, considering the cost of all resources, including those not directly paid.

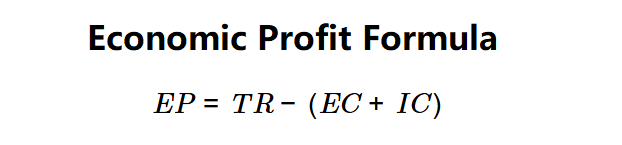

The calculator uses a simple formula to compute economic profit:

Formula:

Steps:

Note: For a deeper understanding, explore the difference between accounting profit (revenue minus explicit costs) and economic profit (revenue minus total opportunity costs) in related resources.

Calculating economic profit is crucial for:

Example 1: \( TR = \$50,000 \), \( EC = \$20,000 \), \( IC = \$15,000 \):

An economic profit of $15,000 indicates a positive return after all costs.

Example 2: \( TR = \$100,000 \), \( EC = \$60,000 \), \( IC = \$50,000 \):

An economic profit of -$10,000 suggests the business is not covering opportunity costs.

Example 3: \( TR = \$30,000 \), \( EC = \$10,000 \), \( IC = \$5,000 \):

An economic profit of $15,000 reflects a healthy return above opportunity costs.

Q: What is economic profit?

A: Economic profit (\( EP \)) is the difference between total revenue (\( TR \)) and the sum of explicit costs (\( EC \)) and implicit costs (\( IC \)), reflecting true economic gain.

Q: How does economic profit differ from accounting profit?

A: Accounting profit excludes implicit costs, while economic profit includes them to account for opportunity costs.

Q: Can economic profit be negative?

A: Yes, if total opportunity costs exceed total revenue, \( EP \) can be negative, indicating an economic loss.