1. What is Earnings Per Share Growth Calculator?

Definition: This calculator computes the EPS growth rate, showing profit growth per share.

Purpose: Helps investors evaluate a company’s profitability trend and investment potential.

2. How Does the Calculator Work?

The calculator supports two modes:

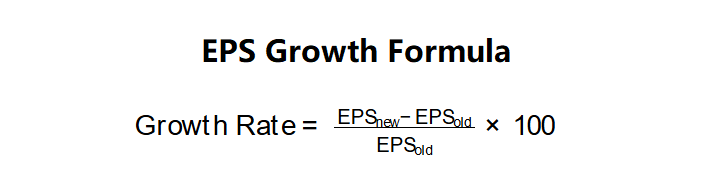

Simple Growth Rate:

\( \text{Growth Rate} = \frac{\text{EPS}_{\text{new}} - \text{EPS}_{\text{old}}}{\text{EPS}_{\text{old}}} \times 100 \)

Where:

- \( \text{EPS}_{\text{new}} \): New EPS (dollars/share)

- \( \text{EPS}_{\text{old}} \): Old EPS (dollars/share)

CAGR:

\( \text{CAGR} = \left( \frac{\text{EPS}_{\text{final}}}{\text{EPS}_{\text{initial}}} \right)^{\frac{1}{P}} \times 100 - 100 \)

Where:

- \( \text{EPS}_{\text{final}} \): Final EPS (dollars/share)

- \( \text{EPS}_{\text{initial}} \): Initial EPS (dollars/share)

- \( P \): Number of Periods (years)

Steps:

- Select calculation mode (Simple or CAGR).

- Enter required EPS values and periods (if CAGR).

- Calculate growth rate as a %.

- Display with 2 decimal places.

3. Importance of EPS Growth

Calculating EPS growth is crucial for:

- Investment Insight: Identifies undervalued or overvalued stocks.

- Performance Trend: Tracks profitability over time.

- Growth Assessment: A rate >15% over 3+ years is often considered good.

4. Using the Calculator

Example 1 (Simple): Old EPS = $2.00, New EPS = $2.50:

- Old EPS: $2.00

- New EPS: $2.50

- Growth Rate: \( \frac{2.50 - 2.00}{2.00} \times 100 = 25.00\% \)

- Result: \( 25.00\% \)

Example 2 (CAGR): Initial EPS = $2.00, Final EPS = $2.50, Periods = 3:

- Initial EPS: $2.00

- Final EPS: $2.50

- Periods: 3 years

- CAGR: \( \left( \frac{2.50}{2.00} \right)^{\frac{1}{3}} \times 100 - 100 \approx 7.71\% \)

- Result: \( 7.71\% \)

Example 3 (CAGR, High Growth): Initial EPS = $1.00, Final EPS = $2.00, Periods = 5:

- Initial EPS: $1.00

- Final EPS: $2.00

- Periods: 5 years

- CAGR: \( \left( \frac{2.00}{1.00} \right)^{\frac{1}{5}} \times 100 - 100 \approx 14.87\% \)

- Result: \( 14.87\% \) (Good growth)

5. Frequently Asked Questions (FAQ)

Q: What is a good EPS growth rate?

A: >15% over 3+ years is typically considered excellent, but compare with stock price.

Q: Why use CAGR?

A: CAGR smooths growth over multiple years, useful for long-term analysis.

Q: Where to find EPS data?

A: Check the income statement or Profit and Loss statement of public companies.

Earnings Per Share Growth Calculator© - All Rights Reserved 2025

Home

Home

Back

Back