Home

Home

Back

Back

Definition: This calculator computes the earnest money deposit (E) required for a property purchase, a good-faith payment showing the buyer’s commitment to the transaction.

Purpose: Helps homebuyers determine the deposit needed to secure a property, aiding in budgeting and understanding seller expectations during negotiations.

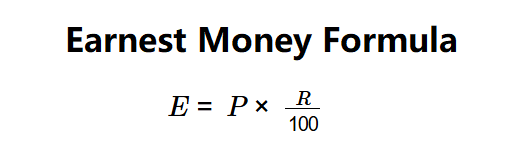

The calculator uses this formula:

Formula:

Steps:

Calculating earnest money is key for:

Example: For a residential property with \( P = \$1,000,000 \), \( R = 5\% \):

This shows the buyer needs a $50,000 deposit to secure the $1,000,000 property.

Q: How is earnest money calculated?

A: Earnest money is calculated in three steps: (1) Determine the property price (\( P \)), typically the listed or negotiated price; (2) Determine the earnest money percentage (\( R \)), set by the seller or negotiated (usually 1–10%); (3) Calculate the deposit using \( E = P \times \frac{R}{100} \). For example, a $1,000,000 property at 5% requires \( E = 1,000,000 \times 0.05 = \$50,000 \).

Q: What is a typical earnest money percentage?

A: Percentages typically range from 1–3% in standard markets but can reach 5–10% in hot markets or for high-demand properties, depending on seller requirements and negotiations.

Q: Is earnest money refundable?

A: It depends on the contract. Earnest money is often refundable if contingencies (e.g., inspection, financing) fail, but may be forfeited if the buyer withdraws without cause. Check the purchase agreement for terms.