1. What is EBITDA Multiple Calculator?

Definition: This calculator computes the EBITDA multiple, a ratio of enterprise value to EBITDA, to assess company valuation.

Purpose: Helps investors and analysts determine if a company is undervalued or overvalued compared to peers.

2. How Does the Calculator Work?

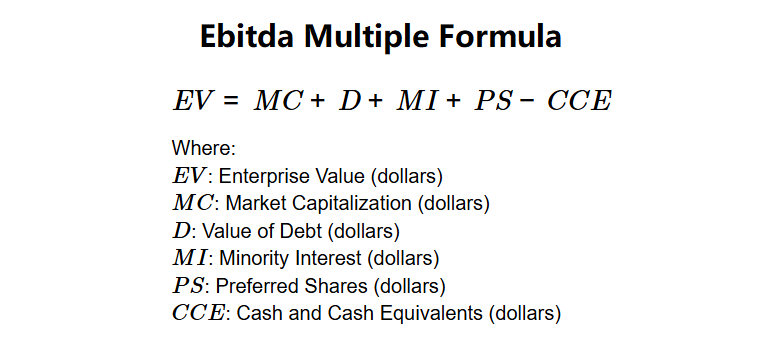

The calculator uses the formula:

Enterprise Value:

\( EV = MC + D + MI + PS - CCE \)

Where:

- \( EV \): Enterprise Value (dollars)

- \( MC \): Market Capitalization (dollars)

- \( D \): Value of Debt (dollars)

- \( MI \): Minority Interest (dollars)

- \( PS \): Preferred Shares (dollars)

- \( CCE \): Cash and Cash Equivalents (dollars)

EBITDA Multiple:

\( \text{EBITDA Multiple} = \frac{EV}{EBITDA} \)

Where:

- \( EBITDA \): Earnings Before Interest, Taxes, Depreciation, and Amortization (dollars)

Steps:

- Enter market cap, debt, minority interest, preferred shares, cash equivalents, and EBITDA.

- Calculate enterprise value.

- Divide by EBITDA to get the multiple.

- Display with 2 decimal places.

3. Importance of EBITDA Multiple

Calculating EBITDA multiple is crucial for:

- Valuation: Compares company value across industries, accounting for debt.

- Investment Decisions: Identifies undervalued (low multiple) or overvalued (high multiple) stocks.

- M&A Analysis: Assesses acquisition cost relative to operating profit.

4. Using the Calculator

Example 1: MC = $400,000, D = $20,000, MI = $5,000, PS = $10,000, CCE = $0, EBITDA = $50,000:

- Enterprise Value: \( 400,000 + 20,000 + 5,000 + 10,000 - 0 = 435,000 \) dollars

- EBITDA Multiple: \( \frac{435,000}{50,000} = 8.70 \)

- Result: EV = 435,000 dollars, Multiple = 8.70

Example 2: MC = $600,000, D = $50,000, MI = $0, PS = $0, CCE = $10,000, EBITDA = $75,000:

- Enterprise Value: \( 600,000 + 50,000 + 0 + 0 - 10,000 = 640,000 \) dollars

- EBITDA Multiple: \( \frac{640,000}{75,000} \approx 8.53 \)

- Result: EV = 640,000 dollars, Multiple = 8.53

5. Frequently Asked Questions (FAQ)

Q: What is a good EBITDA multiple?

A: Depends on industry; lower multiples (e.g., 5-10) may indicate undervaluation, but compare with peers.

Q: Why subtract cash equivalents?

A: Cash reduces the net cost of acquiring a company, as it can offset debt.

Q: Where to find these values?

A: Check company financial statements or sites like Yahoo! Finance.

EBITDA Multiple Calculator© - All Rights Reserved 2025

Home

Home

Back

Back