Home

Home

Back

Back

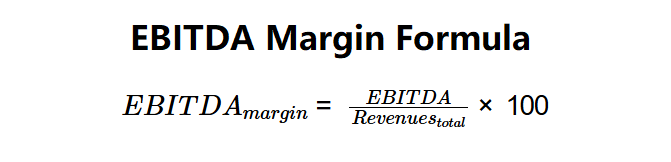

Definition: This calculator computes the EBITDA margin (\( EBITDA_{margin} \)), which measures a company's operating profitability as a percentage of total revenues, excluding interest, taxes, depreciation, and amortization.

Purpose: Helps businesses, investors, and analysts assess operational efficiency, compare profitability across companies, and track financial performance trends over time.

The calculator uses a simple formula to compute the EBITDA margin:

Formula:

Steps:

Note: For a meaningful analysis, review the EBITDA margin trend over at least three years to assess improving operational efficiency.

Calculating the EBITDA margin is crucial for:

Example 1: \( EBITDA = \$50,000 \), \( Revenues_{total} = \$200,000 \):

An EBITDA margin of 25.00% indicates a solid operational profit margin.

Example 2: \( EBITDA = \$100,000 \), \( Revenues_{total} = \$500,000 \):

An EBITDA margin of 20.00% reflects moderate efficiency.

Example 3: \( EBITDA = \$30,000 \), \( Revenues_{total} = \$150,000 \):

An EBITDA margin of 20.00% suggests consistent profitability.

Q: What is EBITDA margin?

A: The EBITDA margin (\( EBITDA_{margin} \)) is the percentage of revenue that remains as EBITDA, indicating operational profitability.

Q: Why analyze EBITDA margin trends?

A: A growing \( EBITDA_{margin} \) over time suggests improving efficiency in covering operating expenses.

Q: Can EBITDA margin be negative?

A: Yes, if \( EBITDA \) is negative (e.g., operating losses exceed non-cash expenses), the margin can be negative.