Home

Home

Back

Back

Definition: This calculator computes the earnings before interest and taxes (\( EBIT \)), which measures a company's profit from operations, excluding interest and tax expenses, providing a clear view of operational performance.

Purpose: Helps businesses, investors, and analysts assess core profitability, compare company performance across industries, and evaluate operational efficiency.

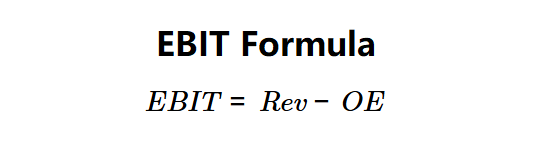

The calculator uses a simple formula to compute EBIT:

Formula:

Steps:

Calculating EBIT is crucial for:

Example 1: \( Rev = \$50,000 \), \( OE = \$24,000 \):

An EBIT of $26,000 indicates a profit of $26,000 from operations.

Example 2: \( Rev = \$100,000 \), \( OE = \$80,000 \):

An EBIT of $20,000 reflects a moderate operational profit.

Example 3: \( Rev = \$30,000 \), \( OE = \$40,000 \):

An EBIT of -$10,000 indicates an operational loss.

Q: What is EBIT?

A: Earnings before interest and taxes (\( EBIT \)) is the profit a company earns from its operations, excluding interest and tax expenses.

Q: Why is EBIT important?

A: It provides a clear view of operational profitability, unaffected by financing decisions or tax environments, aiding in performance analysis.

Q: Can EBIT be negative?

A: Yes, if operating expenses exceed revenue, \( EBIT \) can be negative, indicating an operating loss.