1. What is Effective Annual Yield (EAY)?

Definition: Effective Annual Yield (EAY) is the actual annual rate of return earned on an investment, accounting for the effect of compounding interest from multiple coupon payments throughout the year.

Purpose: EAY provides investors with a way to compare bonds with different coupon payment frequencies on an equal basis.

2. How Does the EAY Calculator Work?

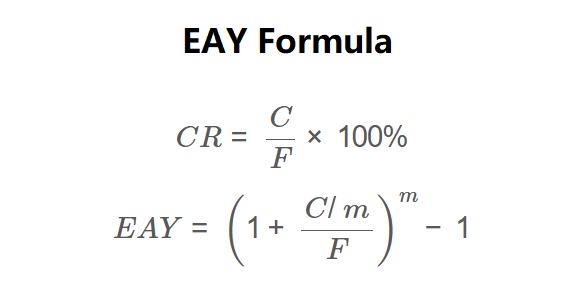

The calculator uses the following formulas:

\[ CR = \frac{C}{F} \times 100\% \]

\[ EAY = \left(1 + \frac{C/m}{F}\right)^m - 1 \]

Where:

- \( F \): Face Value of the bond

- \( C \): Total annual coupon payment

- \( m \): Number of coupon payments per year

- \( CR \): Coupon Rate (annual percentage)

- \( EAY \): Effective Annual Yield

Steps:

- Enter the Face Value of the bond and select currency

- Enter the total Annual Coupon Payment in the same currency

- Select the Coupon Frequency (how often payments are made)

- The calculator first determines the Coupon Rate (CR)

- Then calculates the periodic coupon payment (C/m)

- Determines the periodic yield (periodic payment ÷ face value)

- Calculates the Effective Annual Yield accounting for compounding

- Results are formatted and displayed as percentages

3. Importance of EAY Calculation

Calculating EAY is essential for:

- Bond Comparison: Compare bonds with different payment frequencies

- Investment Decisions: Understand the true yield of fixed-income investments

- Portfolio Management: Accurately assess fixed-income portfolio performance

4. Using the Calculator

Example 1: Calculate for a $1,000 bond with $50 annual coupon paid semi-annually

- Face Value: $1,000

- Annual Coupon: $50

- Coupon Frequency: Semi-annually (2)

- Coupon Rate: (50/1000)×100 = 5.00%

- Periodic Payment: $50/2 = $25

- Periodic Yield: $25/$1000 = 0.025

- EAY: (1 + 0.025)^2 - 1 = 0.050625 or 5.0625%

Example 2: Calculate for a €5,000 bond with €300 annual coupon paid quarterly

- Face Value: €5,000

- Annual Coupon: €300

- Coupon Frequency: Quarterly (4)

- Coupon Rate: (300/5000)×100 = 6.00%

- Periodic Payment: €300/4 = €75

- Periodic Yield: €75/€5000 = 0.015

- EAY: (1 + 0.015)^4 - 1 ≈ 0.06136 or 6.136%

5. Frequently Asked Questions (FAQ)

Q: How does EAY differ from coupon rate?

A: Coupon rate is the simple annual rate, while EAY accounts for compounding from multiple payments.

Q: Why does EAY increase with more frequent payments?

A: More frequent payments allow earlier payments to be reinvested, creating a compounding effect.

Q: Is EAY the same as APY (Annual Percentage Yield)?

A: Yes, they are conceptually similar - both measure the actual annual yield including compounding.

Effective Annual Yield Calculator© - All Rights Reserved 2025

Home

Home

Back

Back