Home

Home

Back

Back

Definition: The Effective Annual Rate (EAR) is the actual interest rate that an investor earns or pays in a year after accounting for compounding.

Purpose: EAR provides a way to compare different investment or loan options with different compounding periods on a consistent basis.

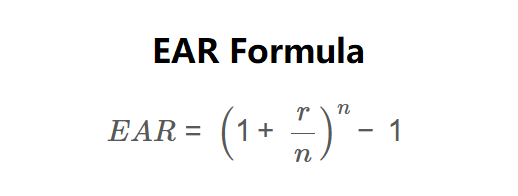

The calculator uses the following formula:

\[ EAR = \left(1 + \frac{r}{n}\right)^n - 1 \]

Where:

Steps:

Calculating EAR is essential for:

Example 1: Calculate EAR for a nominal rate of 8% compounded quarterly

Example 2: Calculate EAR for a nominal rate of 5% compounded monthly

Q: What's the difference between nominal rate and EAR?

A: Nominal rate doesn't account for compounding, while EAR shows the actual annual rate including compounding effects.

Q: Does more frequent compounding always mean higher EAR?

A: Yes, for a given nominal rate, more frequent compounding results in a higher EAR.

Q: What's the maximum possible EAR for a given nominal rate?

A: As compounding frequency approaches infinity, EAR approaches e^r - 1 (continuous compounding).