1. What is DuPont Analysis Calculator?

Definition: This calculator computes ROE and its components (NPM, TAT, FL) using the DuPont formula.

Purpose: Helps analyze a company’s profitability, efficiency, and leverage to assess shareholder value creation.

2. How Does the Calculator Work?

The calculator uses these formulas:

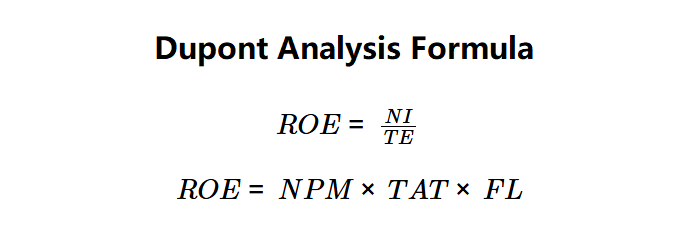

ROE:

\( ROE = \frac{NI}{TE} \)

or

\( ROE = NPM \times TAT \times FL \)

Where:

- \( NI \): Net Income (dollars)

- \( TE \): Total Equity (dollars)

NPM:

\( NPM = \frac{NI}{R} \)

or

\( NPM = \frac{ROE}{TAT \times FL} \)

Where:

- \( R \): Revenue (dollars)

TAT:

\( TAT = \frac{R}{TA} \)

or

\( TAT = \frac{ROE}{NPM \times FL} \)

Where:

- \( TA \): Total Assets (dollars)

FL:

\( FL = \frac{TA}{TE} \)

or

\( FL = \frac{ROE}{NPM \times TAT} \)

Steps:

- Enter net income, revenue, total assets, and total equity.

- Calculate ROE, NPM, TAT, and FL.

- Display results with 2 decimal places.

3. Importance of DuPont Analysis

Calculating DuPont components is crucial for:

- Profitability: Assesses how efficiently revenue turns into profit (NPM).

- Efficiency: Evaluates asset use effectiveness (TAT).

- Leverage: Measures risk from debt financing (FL).

4. Using the Calculator

Example 1: NI = $100,000, R = $500,000, TA = $1,000,000, TE = $400,000:

- \( NPM = \frac{100,000}{500,000} = 20.00\% \)

- \( TAT = \frac{500,000}{1,000,000} = 0.50 \)

- \( FL = \frac{1,000,000}{400,000} = 2.50 \)

- \( ROE = 20.00 \times 0.50 \times 2.50 = 25.00\% \)

- Result: ROE = 25.00%, NPM = 20.00%, TAT = 0.50, FL = 2.50

Example 2: NI = $50,000, R = $200,000, TA = $800,000, TE = $300,000:

- \( NPM = \frac{50,000}{200,000} = 25.00\% \)

- \( TAT = \frac{200,000}{800,000} = 0.25 \)

- \( FL = \frac{800,000}{300,000} = 2.67 \)

- \( ROE = 25.00 \times 0.25 \times 2.67 = 16.68\% \)

- Result: ROE = 16.68%, NPM = 25.00%, TAT = 0.25, FL = 2.67

5. Frequently Asked Questions (FAQ)

Q: What does a high ROE indicate?

A: A high ROE may reflect strong profitability, efficiency, or leverage, but excessive leverage could signal risk.

Q: Why use DuPont analysis?

A: It breaks down ROE to identify specific areas (NPM, TAT, FL) driving performance or risks.

Q: Can FL be too high?

A: Yes, a high FL indicates heavy debt, increasing bankruptcy risk if not managed properly.

DuPont Analysis Calculator© - All Rights Reserved 2025

Home

Home

Back

Back