1. What is Dividend Yield Calculator?

Definition: This calculator computes the dividend yield, the % return from dividends relative to stock price.

Purpose: Helps investors assess dividend income potential and compare stock investments.

2. How Does the Calculator Work?

The calculator follows these steps:

Step 1: Calculate Annual Dividends

\( AD = DP \times DF \)

Where:

- \( AD \): Annual Dividends (dollars)

- \( DP \): Dividend per Period (dollars)

- \( DF \): Dividend Frequency (times/year)

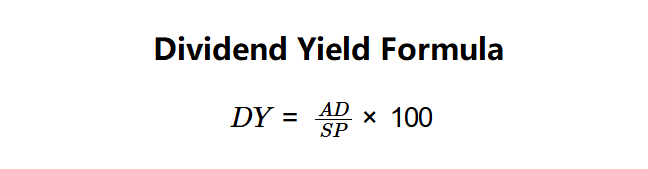

Step 2: Calculate Dividend Yield

\( DY = \frac{AD}{SP} \times 100 \)

Where:

- \( DY \): Dividend Yield (%)

- \( SP \): Share Price (dollars)

Steps:

- Enter dividend per period, frequency, and share price.

- Compute annual dividends.

- Calculate yield as a %.

- Display with 2 decimal places.

3. Importance of Dividend Yield

Calculating dividend yield is crucial for:

- Income Assessment: Evaluates dividend income relative to investment.

- Investment Comparison: Compares stocks based on dividend returns.

- Financial Insight: Indicates company maturity and dividend stability.

4. Using the Calculator

Example 1: Company Alpha - DP = $2.50, DF = 4, SP = $120:

- Dividend per Period (\( DP \)): $2.50

- Dividend Frequency (\( DF \)): 4 (quarterly)

- Share Price (\( SP \)): $120

- Annual Dividends (\( AD \)): \( 2.50 \times 4 = 10.00 \) dollars

- Dividend Yield (\( DY \)): \( \frac{10.00}{120} \times 100 = 8.33\% \)

- Result: \( 8.33\% \)

Example 2: Company Beta - DP = $1.00, DF = 2, SP = $50:

- Dividend per Period (\( DP \)): $1.00

- Dividend Frequency (\( DF \)): 2 (semi-annual)

- Share Price (\( SP \)): $50

- Annual Dividends (\( AD \)): \( 1.00 \times 2 = 2.00 \) dollars

- Dividend Yield (\( DY \)): \( \frac{2.00}{50} \times 100 = 4.00\% \)

- Result: \( 4.00\% \)

Example 3: Company Gamma - DP = $0.50, DF = 12, SP = $30:

- Dividend per Period (\( DP \)): $0.50

- Dividend Frequency (\( DF \)): 12 (monthly)

- Share Price (\( SP \)): $30

- Annual Dividends (\( AD \)): \( 0.50 \times 12 = 6.00 \) dollars

- Dividend Yield (\( DY \)): \( \frac{6.00}{30} \times 100 = 20.00\% \)

- Result: \( 20.00\% \) (Note: High yield may indicate risk)

5. Frequently Asked Questions (FAQ)

Q: What is a good dividend yield?

A: Typically 2-6% is considered good; high yields (>10%) may signal risk if unsustainable.

Q: Why does frequency matter?

A: Frequency determines annual dividends, affecting yield calculation.

Q: Where to find share price?

A: Check financial websites like Yahoo! Finance or Google Search.

Dividend Yield Calculator© - All Rights Reserved 2025

Home

Home

Back

Back