Home

Home

Back

Back

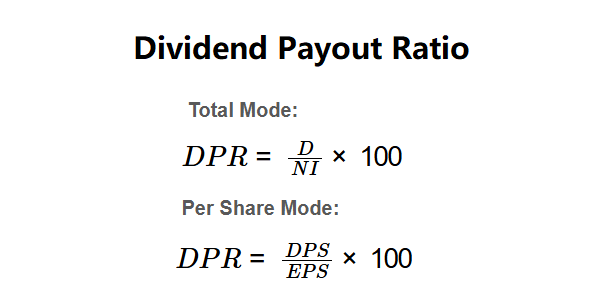

Definition: This calculator determines the DPR, the % of NI or EPS paid out as dividends.

Purpose: Helps investors assess dividend sustainability and company growth potential.

The calculator supports two modes:

Total Mode:

Per Share Mode:

Steps:

Calculating DPR is crucial for:

Example 1 (Total): D = $50,000, NI = $200,000:

Example 2 (Per Share): DPS = $2.50, EPS = $4.00:

Example 3 (Total, High): D = $120,000, NI = $150,000:

Q: What is a good DPR?

A: Varies; 60-75% for mature firms, <50% for growth firms; >80% may be risky.

Q: DPR vs. Yield?

A: DPR is % of earnings paid as dividends; yield is dividends/stock price.

Q: Can DPR > 100%?

A: Yes, if D > NI, but rare, indicating borrowing or reserves use.