1. What is the Dividend Discount Model Calculator?

Definition: The Dividend Discount Model Calculator computes the present value of a stock using the Gordon Growth Model (GGM), a popular variant that assumes dividends grow at a constant rate in perpetuity. It calculates the expected dividend, cost of equity, and expected growth rate based on provided financial inputs.

Purpose: Used by investors to assess the intrinsic value of a stock based on future dividends, aiding in decisions to buy, hold, or sell shares.

2. How Does the Calculator Work?

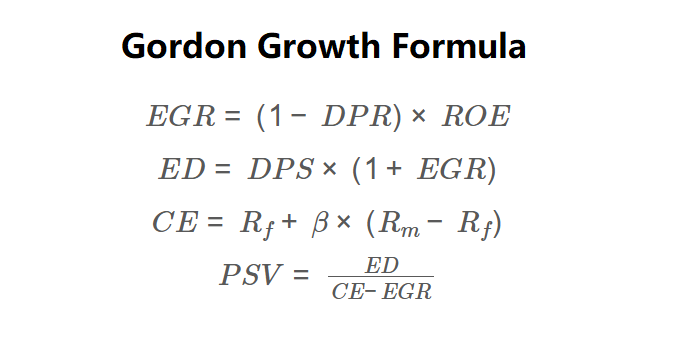

The calculator uses the following formulas:

\( EGR = (1 - DPR) \times ROE \)

\( ED = DPS \times (1 + EGR) \)

\( CE = R_f + \beta \times (R_m - R_f) \)

\( PSV = \frac{ED}{CE - EGR} \)

Where:

- \( PSV \): Present Stock Value ($);

- \( ED \): Expected Dividend ($);

- \( CE \): Cost of Equity (%);

- \( EGR \): Expected Growth Rate (%);

- \( DPS \): Dividends per Share ($);

- \( R_f \): Risk-Free Rate (%);

- \( \beta \): Beta (stock volatility relative to market);

- \( R_m - R_f \): Market Risk Premium (%);

- \( DPR \): Dividend Payout Ratio (%);

- \( ROE \): Return on Equity (%).

Steps:

- Enter the dividends per share (e.g., $2).

- Enter the risk-free rate (e.g., 2.4).

- Enter the beta (e.g., 0.47).

- Enter the market risk premium (e.g., 5.6).

- Enter the dividend payout ratio as a percentage (e.g., 50).

- Enter the return on equity (e.g., 10).

- Calculate the expected growth rate: \( EGR = (1 - DPR) \times ROE \).

- Calculate the expected dividend: \( ED = DPS \times (1 + EGR) \).

- Calculate the cost of equity: \( CE = R_f + \beta \times (R_m - R_f) \).

- Calculate the present stock value: \( PSV = \frac{ED}{CE - EGR} \).

- Display the expected growth rate (%), expected dividend ($), cost of equity (%), and present stock value ($), formatted appropriately.

3. Importance of Dividend Discount Model Calculation

Calculating the present stock value is essential for:

- Investment Decisions: Helps investors determine if a stock is undervalued (when \( PSV > \) market price) or overvalued (when \( PSV < \) market price).

- Valuation Benchmarking: Provides a theoretical fair value based on dividend growth, useful for comparing against market prices.

- Financial Analysis: Assists in evaluating a company’s dividend policy, growth potential, and required return on equity.

4. Using the Calculator

Example 1: Calculate the present stock value with \( DPS = \$2 \), \( R_f = 2.4\% \), \( \beta = 0.47 \), \( MRP = 5.6\% \), \( DPR = 50\% \), \( ROE = 10\% \):

- \( DPS \): $2;

- \( R_f \): 2.4% (0.024);

- \( \beta \): 0.47;

- \( MRP \): 5.6% (0.056);

- \( DPR \): 50% (0.5);

- \( ROE \): 10% (0.10);

- \( EGR \): \( (1 - 0.5) \times 0.10 = 0.05 \) (5%);

- \( ED \): \( 2 \times (1 + 0.05) = 2 \times 1.05 = 2.10 \);

- \( CE \): \( 0.024 + 0.47 \times 0.056 = 0.024 + 0.02632 = 0.05032 \) (5.032%);

- \( PSV \): \( \frac{2.10}{0.05032 - 0.05} = \frac{2.10}{0.00032} \approx 6562.50 \).

Result: Expected Growth Rate = 5.0000%, Expected Dividend = $2.10, Cost of Equity = 5.0320%, Present Stock Value = $6,562.50.

Example 2: Calculate the present stock value with \( DPS = \$5 \), \( R_f = 3\% \), \( \beta = 1.2 \), \( MRP = 7\% \), \( DPR = 40\% \), \( ROE = 12\% \):

- \( DPS \): $5;

- \( R_f \): 3% (0.03);

- \( \beta \): 1.2;

- \( MRP \): 7% (0.07);

- \( DPR \): 40% (0.4);

- \( ROE \): 12% (0.12);

- \( EGR \): \( (1 - 0.4) \times 0.12 = 0.6 \times 0.12 = 0.072 \) (7.2%);

- \( ED \): \( 5 \times (1 + 0.072) = 5 \times 1.072 = 5.36 \);

- \( CE \): \( 0.03 + 1.2 \times 0.07 = 0.03 + 0.084 = 0.114 \) (11.4%);

- \( PSV \): \( \frac{5.36}{0.114 - 0.072} = \frac{5.36}{0.042} \approx 127.62 \).

Result: Expected Growth Rate = 7.2000%, Expected Dividend = $5.36, Cost of Equity = 11.4000%, Present Stock Value = $127.62.

5. Frequently Asked Questions (FAQ)

Q: What is the Gordon Growth Model?

A: The Gordon Growth Model calculates the present stock value (\( PSV \)) by discounting an infinite stream of dividends, where the expected dividend (\( ED \)) grows at a constant rate (\( EGR \)), divided by the cost of equity (\( CE \)).

Q: Why must the cost of equity exceed the growth rate?

A: The cost of equity (\( CE \)) must exceed the expected growth rate (\( EGR \)) to ensure a positive denominator, avoiding undefined or negative stock values.

Q: How are the inputs derived?

A: \( EGR \) is calculated as \( (1 - DPR) \times ROE \), \( ED \) as \( DPS \times (1 + EGR) \), and \( CE \) as \( R_f + \beta \times (R_m - R_f) \), using provided financial data.

Dividend Discount Model Calculator© - All Rights Reserved 2025

Home

Home

Back

Back