Home

Home

Back

Back

Definition: The Disposable Income Calculator computes the income available for spending or saving after subtracting taxes and adding government transfers

Purpose: Helps individuals assess their financial flexibility for personal expenses, savings, or investments based on current income and tax policies.

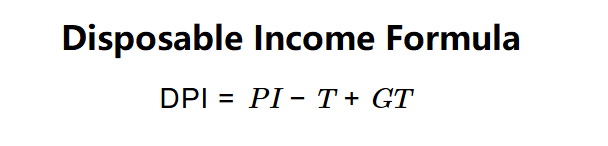

The calculator estimates disposable income using the following formula and steps:

Formula:

Steps:

Calculating disposable income is crucial for:

Example: Personal income = $50,000, Government taxes = $10,000, Government transfers = $2,000:

This represents the income available for spending or saving as of July 03, 2025.

Q: What is disposable income?

A: Disposable income is the amount left after taxes are paid and transfers are added, available for personal use.

Q: How does it differ from discretionary income?

A: Disposable income is after taxes and transfers; discretionary income further subtracts essential expenses (e.g., 150% of poverty guideline for student loans).

Q: Can disposable income be negative?

A: No, if transfers exceed income minus taxes, it’s treated as zero for practical purposes, though this calculator allows negative input for flexibility.