Home

Home

Back

Back

Definition: The Discounted Payback Period Calculator computes the time required for a project to recover its initial investment in present value terms, assuming uniform annual cash inflows and using a logarithmic formula to account for the time value of money.

Purpose: It helps investors and managers assess the risk and profitability of a project by determining how quickly the investment can be recovered, considering a discount rate and constant cash inflows.

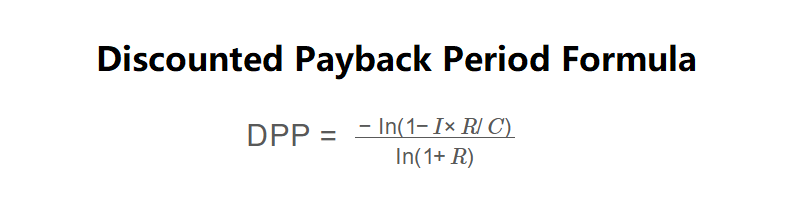

The calculator uses the following formula, as shown in the image above:

\( \text{DPP} = \frac{-\ln(1 - I \times R / C)}{\ln(1 + R)} \)

Where:

Steps:

Calculating the discounted payback period is essential for:

Example 1: Calculate the discounted payback period for a project with an initial investment of $10,000, a discount rate of 10%, and annual cash inflows of $3,000:

Example 2: Calculate the discounted payback period for a project with an initial investment of $20,000, a discount rate of 5%, and annual cash inflows of $6,000:

Q: What does the discounted payback period tell us?

A: It indicates the time needed to recover the initial investment in present value terms, accounting for the time value of money, assuming uniform cash inflows.

Q: Why does the formula require \( I \times R / C < 1 \)?

A: This condition ensures the project can recover its investment. If \( I \times R / C \geq 1 \), the discounted cash inflows may never cover the initial investment, making the DPP undefined or infinite.

Q: How does this DPP calculation differ from other methods?

A: This method assumes constant annual cash inflows and uses a logarithmic formula for continuous discounting, while other methods may calculate DPP by summing discounted cash flows year by year for variable cash flows.