1. What is the Discount Rate Calculator?

Definition: This calculator computes the discount rate (\( DR \)) that equates the Present Value (\( PV \)) of an investment to its Future Value (\( FV \)) over a specified number of periods (\( n \)) with a given compounding frequency (\( m \)).

Purpose: Investors and financial analysts use this tool to determine the rate of return or discount rate needed to achieve a specific future value from a present investment, aiding in financial planning and investment analysis.

2. How Does the Calculator Work?

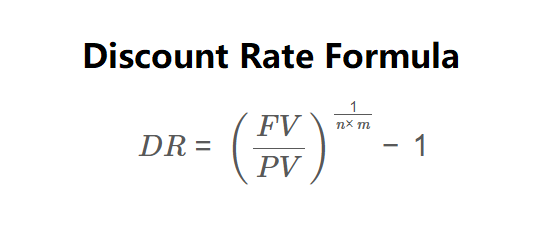

The calculator uses the following formula, as shown in the image above:

\[ DR = \left( \frac{FV}{PV} \right)^{\frac{1}{n \times m}} - 1 \]

Where:

- \( PV \): Present Value (in selected currency);

- \( FV \): Future Value (in selected currency);

- \( n \): Number of Periods (in years);

- \( m \): Compounding frequency per year;

- \( DR \): Discount Rate per compounding period (converted to an annual percentage).

Steps:

- Enter the Present Value (\( PV \)) and select the currency (USD, EUR, GBP, JPY).

- Enter the Future Value (\( FV \)) in the same currency.

- Enter the Number of Periods (\( n \)) in years.

- Select the Compounding Frequency (\( m \)) from the options: Annually (1), Quarterly (4), Monthly (12), or Daily (365).

- The calculator computes the discount rate per compounding period using the formula above, converts it to an annual rate (\( DR \times m \times 100 \)), and displays it as a percentage.

- The result is formatted (scientific notation for values < 0.001, otherwise 4 decimal places) and displayed as a percentage per year.

3. Importance of Discount Rate Calculation

Calculating the discount rate is essential for:

- Investment Analysis: Determines the rate of return needed to justify an investment based on its present and future values.

- Valuation: Used in financial models to discount future cash flows to their present value, aiding in project or business valuation.

- Decision Making: Helps compare investment opportunities by providing a standardized rate of return metric.

4. Using the Calculator

Example 1: Calculate the discount rate for an investment with a Present Value of $10,000, a Future Value of $12,763, a term of 5 years, and annual compounding, in USD:

- Present Value (\( PV \)): $10,000;

- Future Value (\( FV \)): $12,763;

- Number of Periods (\( n \)): 5 years;

- Compounding Frequency (\( m \)): Annually = 1;

- Discount Rate (\( DR \)): \( \left( \frac{12,763}{10,000} \right)^{\frac{1}{5 \times 1}} - 1 = (1.2763)^{\frac{1}{5}} - 1 = 1.05 - 1 = 0.05 \), Annual Rate = \( 0.05 \times 1 \times 100 = 5.0000\%/year \).

Example 2: Calculate the discount rate for an investment with a Present Value of €15,000, a Future Value of €16,386.24, a term of 2 years, and quarterly compounding, in EUR:

- Present Value (\( PV \)): €15,000;

- Future Value (\( FV \)): €16,386.24;

- Number of Periods (\( n \)): 2 years;

- Compounding Frequency (\( m \)): Quarterly = 4;

- Discount Rate (\( DR \)): \( \left( \frac{16,386.24}{15,000} \right)^{\frac{1}{2 \times 4}} - 1 = (1.092416)^{\frac{1}{8}} - 1 \approx 0.01109 \), Annual Rate = \( 0.01109 \times 4 \times 100 = 4.4360\%/year \).

5. Frequently Asked Questions (FAQ)

Q: Why does compounding frequency affect the calculated rate?

A: The frequency of compounding changes the effective rate. More frequent compounding results in a slightly lower annual rate to achieve the same future value.

Q: Can the discount rate be negative?

A: Yes, if the Future Value is less than the Present Value, the discount rate will be negative, indicating a loss over the term.

Q: What if the Future Value equals the Present Value?

A: If \( FV = PV \), the discount rate will be 0%, indicating no growth or loss over the term.

Discount Rate Calculator© - All Rights Reserved 2025

Home

Home

Back

Back