Home

Home

Back

Back

Definition: This calculator computes the Direct Material Price Variance (DMPV), which is the difference between the actual cost of direct materials and the standard cost, based on the quantity purchased or used. It measures the efficiency of the purchasing department in acquiring materials at the expected cost.

Purpose: It is used by businesses to monitor material costs, evaluate supplier performance, and identify cost control opportunities, ensuring financial efficiency in production processes.

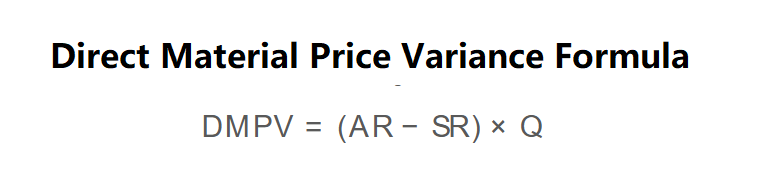

The calculator uses the following formula, as shown in the image above:

\( \text{DMPV} = (\text{AR} - \text{SR}) \times \text{Q} \)

Where:

Steps:

Calculating the DMPV is essential for:

Example 1: Calculate the DMPV for a company with a standard rate of $10 per unit, an actual rate of $12 per unit, and a quantity of 1,000 units:

Example 2: Calculate the DMPV for a company with a standard rate of $5 per unit, an actual rate of $4.50 per unit, and a quantity of 2,000 units:

Q: What does an unfavorable DMPV indicate?

A: An unfavorable DMPV (positive value) indicates that the actual cost of materials was higher than the standard cost, suggesting inefficiencies in purchasing, such as paying above-market prices or failing to negotiate discounts.

Q: Can a favorable DMPV have negative consequences?

A: Yes, a favorable DMPV (negative value) might indicate cost savings, but it could also result from purchasing lower-quality materials, which may lead to increased waste or production issues, potentially causing an unfavorable material quantity variance.

Q: How can a business improve its DMPV?

A: Businesses can improve DMPV by negotiating better prices with suppliers, purchasing in bulk to secure discounts, conducting market analysis to monitor price trends, and maintaining strong supplier relationships to ensure consistent pricing.