Home

Home

Back

Back

Definition: This calculator computes the debt-to-equity ratio (\( DER \)), which measures a company’s financial leverage by comparing its total liabilities to shareholders' equity.

Purpose: Helps investors, creditors, and managers assess how much a company relies on debt versus equity to finance its operations, indicating financial risk and stability.

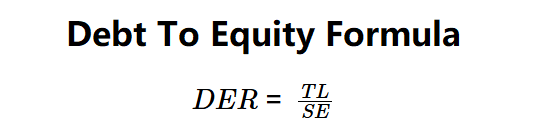

The calculator uses the following formula to compute the result:

Formula:

Steps:

Calculating the debt-to-equity ratio is crucial for:

Example 1: \( TL = \$100,000 \), \( SE = \$200,000 \):

A D/E ratio of 0.50 indicates low leverage, suggesting financial stability.[

Example 2: \( TL = \$500,000 \), \( SE = \$200,000 \):

A D/E ratio of 2.50 indicates high leverage, posing higher risk, though acceptable in capital-intensive industries.

Example 3: \( TL = \$60,000 \), \( SE = \$100,000 \):

A D/E ratio of 0.60 suggests moderate leverage, attractive to lenders.

Q: What is a good debt-to-equity ratio?

A: Ratios of 1.0–1.5 are generally considered safe, but vary by industry; capital-intensive sectors like manufacturing may have ratios around 2.0.

Q: Can the debt-to-equity ratio be negative?

A: Yes, if shareholders' equity is negative (liabilities exceed assets), indicating financial distress.

Q: Why use total liabilities instead of just debt?

A: Total liabilities provide a comprehensive view of obligations, though some analyses use only interest-bearing debt for specificity.