1. What is the Debt-to-Capital Ratio Calculator?

Definition: This calculator computes the debt-to-capital ratio (\( DCR \)), which measures the proportion of a company’s capital structure financed by debt, along with the total capital used in the calculation.

Purpose: Helps investors, creditors, and managers assess a company’s financial leverage, indicating the balance between debt and equity financing.

2. How Does the Calculator Work?

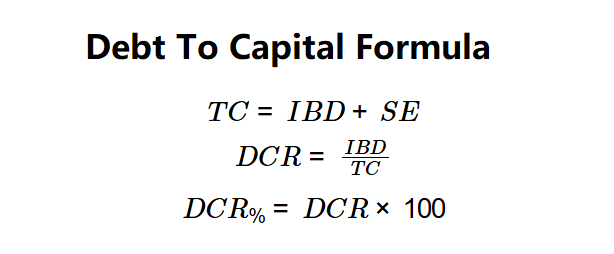

The calculator uses the following formulas to compute the results:

Formulas:

\( TC = IBD + SE \)

\( DCR = \frac{IBD}{TC} \)

\( DCR_{\%} = DCR \times 100 \)

Where:

- \( TC \): Total Capital (dollars)

- \( IBD \): Interest-Bearing Debt (dollars)

- \( SE \): Shareholders' Equity (dollars)

- \( DCR \): Debt-to-Capital Ratio (decimal)

- \( DCR_{\%} \): Debt-to-Capital Ratio (percentage)

Steps:

- Step 1: Determine interest-bearing debt. Use the company’s total interest-bearing debt (\( IBD \)).

- Step 2: Determine shareholders' equity. Use the total equity, including preferred stock and minority interest (\( SE \)).

- Step 3: Calculate debt-to-capital ratio. Compute \( TC = IBD + SE \), then \( DCR = \frac{IBD}{TC} \) and \( DCR_{\%} = DCR \times 100 \).

3. Importance of Debt-to-Capital Ratio Calculation

Calculating the debt-to-capital ratio is crucial for:

- Financial Leverage: A higher ratio indicates greater reliance on debt, increasing risk but potentially boosting returns, per Investopedia.

- Creditworthiness: Creditors assess the ratio to evaluate repayment risk.

- Investment Decisions: Investors use it to gauge capital structure stability.

4. Using the Calculator

Example 1: \( IBD = \$200,000 \), \( SE = \$300,000 \):

- Step 1: \( IBD = \$200,000 \).

- Step 2: \( SE = \$300,000 \).

- Step 3:

- \( TC = 200,000 + 300,000 = \$500,000 \).

- \( DCR = \frac{200,000}{500,000} = 0.40 \).

- \( DCR_{\%} = 0.40 \times 100 = 40\% \).

- Results: \( TC = \$500,000 \), \( DCR = 0.40 \), \( DCR_{\%} = 40\% \).

A 40% ratio indicates 40% of capital is debt-financed, suggesting moderate leverage.

Example 2: \( IBD = \$400,000 \), \( SE = \$100,000 \):

- Step 1: \( IBD = \$400,000 \).

- Step 2: \( SE = \$100,000 \).

- Step 3:

- \( TC = 400,000 + 100,000 = \$500,000 \).

- \( DCR = \frac{400,000}{500,000} = 0.80 \).

- \( DCR_{\%} = 0.80 \times 100 = 80\% \).

- Results: \( TC = \$500,000 \), \( DCR = 0.80 \), \( DCR_{\%} = 80\% \).

An 80% ratio indicates high leverage, posing greater risk.

Example 3: \( IBD = \$50,000 \), \( SE = \$200,000 \):

- Step 1: \( IBD = \$50,000 \).

- Step 2: \( SE = \$200,000 \).

- Step 3:

- \( TC = 50,000 + 200,000 = \$250,000 \).

- \( DCR = \frac{50,000}{250,000} = 0.20 \).

- \( DCR_{\%} = 0.20 \times 100 = 20\% \).

- Results: \( TC = \$250,000 \), \( DCR = 0.20 \), \( DCR_{\%} = 20\% \).

A 20% ratio suggests low leverage, indicating stability.

5. Frequently Asked Questions (FAQ)

Q: What is a good debt-to-capital ratio?

A: A ratio below 50% is often considered healthy, though it varies by industry; lower ratios indicate less risk.

Q: Why include total capital in outputs?

A: Displaying \( TC \) clarifies the denominator, aiding result verification.

Q: Can the debt-to-capital ratio exceed 100%?

A: No, since \( TC = IBD + SE \), the ratio \( \frac{IBD}{TC} \) ranges from 0% to 100%.

Debt-to-Capital Ratio Calculator© - All Rights Reserved 2025

Home

Home

Back

Back