Home

Home

Back

Back

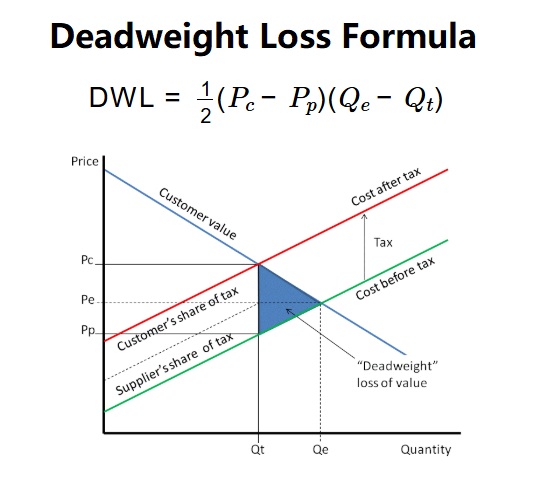

Definition: The Deadweight Loss Calculator measures the economic loss due to market inefficiencies, such as taxes or subsidies, calculated as the area of a triangle formed by price and quantity changes.

Purpose: Helps economists and policymakers assess the cost of market interventions, guiding decisions to minimize inefficiencies

The calculator computes deadweight loss based on the following formula and steps:

Formula:

Steps:

Calculating deadweight loss is crucial for:

Example: \( P_p = 10 \), \( P_c = 12 \), \( Q_e = 100 \), \( Q_t = 80 \):

This represents the loss in economic welfare due to a $2 tax reducing quantity from 100 to 80 units as of July 03, 2025.

Q: What is deadweight loss?

A: Deadweight loss is the reduction in total economic surplus (consumer and producer surplus) due to market inefficiencies like taxes or price floors.

Q: Why does deadweight loss increase with price or quantity changes?

A: Larger deviations from equilibrium (higher \( P_c - P_p \) or \( Q_e - Q_t \)) expand the triangle area, increasing the loss.

Q: Can deadweight loss be zero?

A: Yes, if \( P_c = P_p \) and \( Q_t = Q_e \), indicating no market intervention.