Home

Home

Back

Back

Definition: This calculator computes the days sales outstanding (\( DSO \)), which measures the average number of days it takes a company to collect payment after a sale, indicating accounts receivable efficiency.

Purpose: Helps businesses and analysts assess the efficiency of credit and collection processes, manage cash flow, and evaluate financial health.

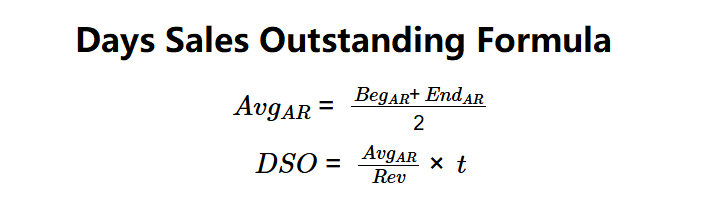

The calculator uses a two-step process to compute DSO:

Formulas:

Steps:

Calculating DSO is crucial for:

Example 1 (Company Alpha): \( Beg_{AR} = \$300,000 \), \( End_{AR} = \$250,000 \), \( Rev = \$5,000,000 \), \( t = 365 \):

A DSO of 20.08 days indicates efficient collection processes.

Example 2: \( Beg_{AR} = \$500,000 \), \( End_{AR} = \$600,000 \), \( Rev = \$4,000,000 \), \( t = 365 \):

A DSO of 50.19 days suggests slower collection, potentially impacting cash flow.

Example 3: \( Beg_{AR} = \$100,000 \), \( End_{AR} = \$120,000 \), \( Rev = \$2,000,000 \), \( t = 365 \):

A DSO of 20.08 days indicates efficient receivable collection.

Q: What is days sales outstanding?

A: Days sales outstanding (\( DSO \)) is the average number of days it takes to collect payment after a sale, reflecting accounts receivable efficiency.

Q: What is a good DSO value?

A: A lower \( DSO \) (e.g., 30-45 days) is generally better, indicating faster collections, though this varies by industry.

Q: Can DSO be negative?

A: No, since \( Avg_{AR} \), \( Rev \), and \( t \) are non-negative, \( DSO \) is non-negative.