1. What is the Days Payable Outstanding Calculator?

Definition: This calculator computes the days payable outstanding (\( DPO \)), which measures the average number of days a company takes to pay its suppliers, indicating payment efficiency.

Purpose: Helps businesses and analysts assess accounts payable management, optimize cash flow, and evaluate supplier payment terms.

2. How Does the Calculator Work?

The calculator uses a three-step process to compute DPO:

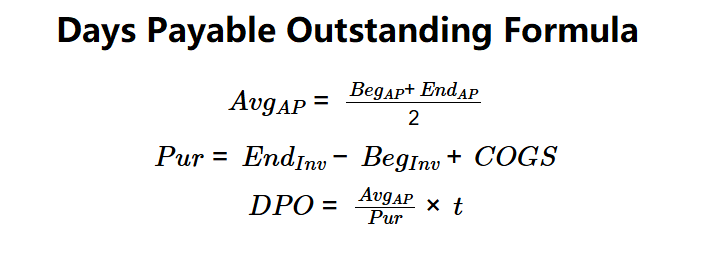

Formulas:

\( Avg_{AP} = \frac{Beg_{AP} + End_{AP}}{2} \)

\( Pur = End_{Inv} - Beg_{Inv} + COGS \)

\( DPO = \frac{Avg_{AP}}{Pur} \times t \)

Where:

- \( DPO \): Days Payable Outstanding (days)

- \( Avg_{AP} \): Average Accounts Payable (dollars)

- \( Beg_{AP} \): Beginning Accounts Payable (dollars)

- \( End_{AP} \): Ending Accounts Payable (dollars)

- \( Pur \): Purchases (dollars)

- \( Beg_{Inv} \): Beginning Inventory (dollars)

- \( End_{Inv} \): Ending Inventory (dollars)

- \( COGS \): Cost of Goods Sold (dollars)

- \( t \): Days in Accounting Period (days)

Steps:

- Step 1: Calculate \( Avg_{AP} \). Average the beginning and ending accounts payable.

- Step 2: Calculate \( Pur \). Compute purchases as ending inventory minus beginning inventory plus COGS.

- Step 3: Calculate \( DPO \). Divide \( Avg_{AP} \) by \( Pur \) and multiply by \( t \).

3. Importance of Days Payable Outstanding Calculation

Calculating DPO is crucial for:

- Cash Flow Management: A higher \( DPO \) indicates slower payments, preserving cash longer.

- Supplier Relations: Helps balance timely payments with cash flow optimization.

- Financial Health: Provides insight into payment practices and liquidity management.

4. Using the Calculator

Example 1 (Alan's Amazing Anglegrinders):

\( Beg_{AP} = \$150,000 \), \( End_{AP} = \$200,000 \), \( Beg_{Inv} = \$200,000 \), \( End_{Inv} = \$400,000 \), \( COGS = \$150,000 \), \( t = 365 \):

- Step 1: \( Avg_{AP} = \frac{150,000 + 200,000}{2} = \$175,000 \).

- Step 2: \( Pur = 400,000 - 200,000 + 150,000 = \$350,000 \).

- Step 3: \( DPO = \frac{175,000}{350,000} \times 365 = 182.50 \) days.

- Results: \( Avg_{AP} = \$175,000 \), \( Pur = \$350,000 \), \( DPO = 182.50 \) days.

A DPO of 182.50 days indicates slow supplier payments, preserving cash flow.

Example 2:

\( Beg_{AP} = \$100,000 \), \( End_{AP} = \$120,000 \), \( Beg_{Inv} = \$300,000 \), \( End_{Inv} = \$350,000 \), \( COGS = \$200,000 \), \( t = 365 \):

- Step 1: \( Avg_{AP} = \frac{100,000 + 120,000}{2} = \$110,000 \).

- Step 2: \( Pur = 350,000 - 300,000 + 200,000 = \$250,000 \).

- Step 3: \( DPO = \frac{110,000}{250,000} \times 365 \approx 160.60 \) days.

- Results: \( Avg_{AP} = \$110,000 \), \( Pur = \$250,000 \), \( DPO = 160.60 \) days.

A DPO of 160.60 days suggests moderate payment delays.

Example 3:

\( Beg_{AP} = \$50,000 \), \( End_{AP} = \$60,000 \), \( Beg_{Inv} = \$500,000 \), \( End_{Inv} = \$450,000 \), \( COGS = \$300,000 \), \( t = 365 \):

- Step 1: \( Avg_{AP} = \frac{50,000 + 60,000}{2} = \$55,000 \).

- Step 2: \( Pur = 450,000 - 500,000 + 300,000 = \$250,000 \).

- Step 3: \( DPO = \frac{55,000}{250,000} \times 365 \approx 80.30 \) days.

- Results: \( Avg_{AP} = \$55,000 \), \( Pur = \$250,000 \), \( DPO = 80.30 \) days.

A DPO of 80.30 days indicates faster supplier payments.

5. Frequently Asked Questions (FAQ)

Q: What is days payable outstanding?

A: Days payable outstanding (\( DPO \)) is the average number of days a company takes to pay its suppliers, reflecting payment efficiency.

Q: What is a good DPO value?

A: A higher \( DPO \) (e.g., 60-90 days) can benefit cash flow but varies by industry; too high may strain supplier relations.

Q: Can DPO be negative?

A: No, since \( Avg_{AP} \), \( Pur \), and \( t \) are typically non-negative, \( DPO \) is non-negative.

Days Payable Outstanding Calculator© - All Rights Reserved 2025

Home

Home

Back

Back