Home

Home

Back

Back

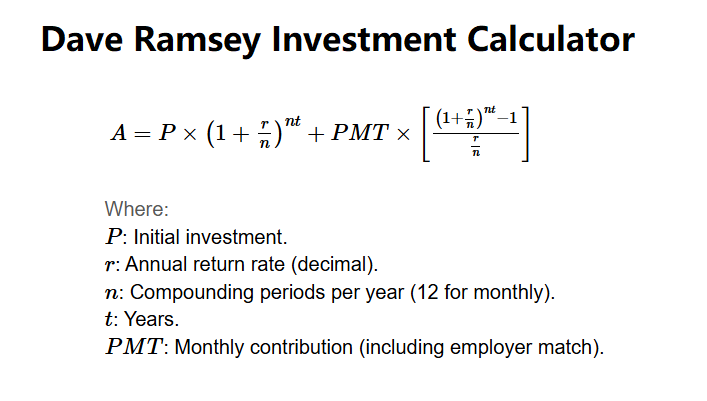

The Ramsey Investment Calculator estimates long-term investment growth using compound interest with monthly contributions. The basic formula is:

Where:

Employer match is calculated as (annual salary × match %) / 12 and added to monthly contribution. The annual increase applies only to the employee's monthly contribution; the match remains fixed. Inflation adjusts the final value: \( A / (1 + i)^t \), where \( i \) is inflation rate. Monthly retirement income uses the 4% rule: (future value × 0.04) / 12. Real Monthly Income is the inflation-adjusted version: (adjusted value × 0.04) / 12. The 25-year value is calculated using the same inputs but with a fixed 25-year duration.

Enter the inputs and calculate to see projected growth.

This calculator helps plan retirement by estimating investment growth based on Dave Ramsey's principles, including compound interest and employer matches.

Input initial investment, monthly contribution, return rate, years, employer match %, salary, inflation rate, and contribution increase %. The calculator outputs future value, inflation-adjusted value, total contributions, growth, monthly retirement income, real monthly income, and the final value after 25 years.

Example: Initial $10,000, monthly $500, 12% return, 25 years, 3% match on $60,000 salary, 3% inflation, 3% increase.

Use this tool for financial planning and retirement projections.

Below are frequently asked questions about the Ramsey Investment Calculator: