Home

Home

Back

Back

Definition: This calculator computes the debt service coverage ratio (\( DSCR \)), which measures a property’s ability to cover debt payments using its net operating income, along with the input values for NOI and debt service.

Purpose: Helps lenders and investors assess the financial health of a property or business, determining if income sufficiently covers debt obligations.

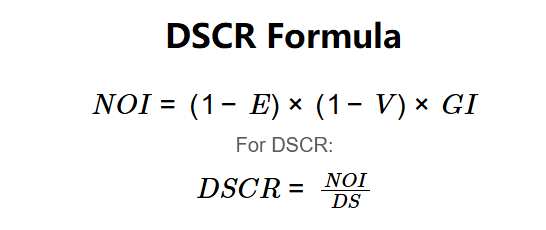

The calculator uses the following formulas to compute the results:

Formulas:

If NOI is calculated:

For DSCR:

Steps:

Calculating the DSCR is crucial for:

Example 1 (Direct NOI): \( NOI = \$2,000 \), \( DS = \$1,500 \):

A DSCR of 1.33 indicates the property generates 33% more income than needed to cover debt.

Example 2 (Calculated NOI): \( GI = \$3,000 \), \( E = 20\% \), \( V = 5\% \), \( DS = \$1,200 \):

A DSCR of 1.90 suggests strong debt coverage.

Example 3 (Calculated NOI): \( GI = \$5,000 \), \( E = 30\% \), \( V = 10\% \), \( DS = \$3,000 \):

A DSCR of 1.05 indicates marginal debt coverage, posing higher risk.

Q: What is a good DSCR?

A: A DSCR > 1 is typically required, with 1.2–1.5 often preferred by lenders, indicating sufficient income to cover debt, per Investopedia.

Q: Why calculate NOI?

A: NOI reflects the property’s income after operating expenses and vacancies, critical for assessing debt repayment capacity.

Q: Can DSCR be negative?

A: Yes, if NOI is negative (e.g., high expenses or vacancies), but this indicates severe financial distress.