Home

Home

Back

Back

Definition: This calculator computes the current ratio (\( CR \)), which measures a company's ability to cover its current liabilities with its current assets, indicating short-term financial health.

Purpose: Helps businesses, investors, and creditors assess liquidity and the ability to meet short-term obligations using assets that can be converted to cash within a year.

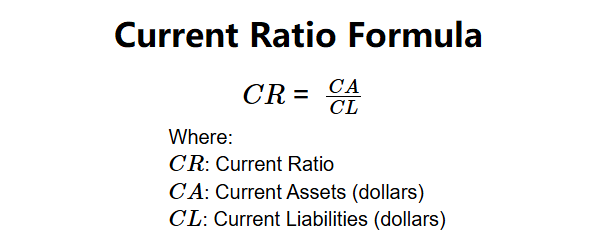

The calculator uses a simple formula to compute the current ratio:

Formula:

Steps:

Calculating the current ratio is crucial for:

Example 1: \( CA = \$20,000,000 \), \( CL = \$10,000,000 \):

A current ratio of 2.00x indicates the company can cover its liabilities twice with current assets.

Example 2: \( CA = \$5,000,000 \), \( CL = \$8,000,000 \):

A current ratio of 0.63x suggests potential liquidity challenges.

Example 3: \( CA = \$15,000,000 \), \( CL = \$5,000,000 \):

A current ratio of 3.00x indicates strong liquidity.

Q: What is the current ratio?

A: The current ratio (\( CR \)) measures a company's ability to pay off its current liabilities (\( CL \)) using its current assets (\( CA \)).

Q: What is a good current ratio?

A: A \( CR \) between 1.5 and 3 is generally considered healthy, indicating sufficient liquidity without excessive idle assets.

Q: Can the current ratio be negative?

A: No, since \( CA \) and \( CL \) are non-negative, \( CR \) is non-negative.