Home

Home

Back

Back

Definition: The Currency Forward Calculator computes the forward price of the GBP/MYR currency pair based on the spot price and adjusted interest rates over a specified contract period.

Purpose: Helps traders and businesses determine future exchange rates for hedging or speculation, accounting for interest rate differentials between GBP and MYR.

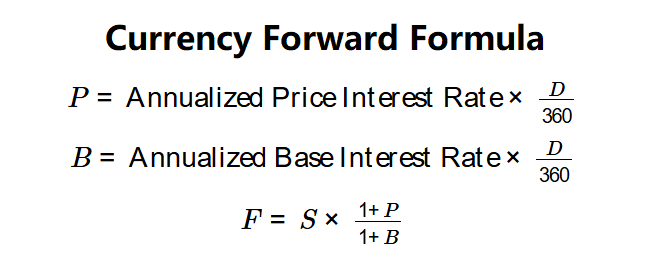

The calculator evaluates the currency forward price in four steps using these formulas:

Formulas:

Steps:

Calculating the currency forward price is crucial for:

Example (GBP/MYR): Days: 90, Annualized GBP Interest Rate: 0.8%, Annualized MYR Interest Rate: 3.2%, Spot Price: 0.1735:

The forward price of 0.1725 indicates the expected GBP/MYR exchange rate after 90 days, adjusted for interest rate differentials.

Q: What is a currency forward?

A: A currency forward is a contract to buy or sell GBP/MYR at a set price on a future date, based on current spot price and interest rates.

Q: Why are interest rates important in forward pricing?

A: They reflect the cost of borrowing or lending each currency, influencing the forward price through interest rate differentials.

Q: Can the forward price be lower than the spot price?

A: Yes, if the MYR interest rate exceeds the GBP interest rate, as seen in the example (0.1725 < 0.1735).