Home

Home

Back

Back

Definition: The Credit Utilization Calculator determines the percentage of total credit used relative to the total credit limit across multiple credit cards, known as the credit utilization rate.

Purpose: This tool helps individuals monitor their credit usage, which impacts credit scores. A lower utilization rate (typically below 30%) is generally better for maintaining a healthy credit profile.

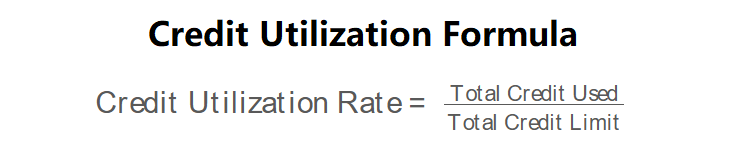

The calculator uses the following formula:

\( \text{Credit Utilization Rate} = \frac{\text{Total Credit Used}}{\text{Total Credit Limit}} \)

Where:

Steps:

Calculating the credit utilization rate is essential for:

Example: Calculate the credit utilization rate for a household with three credit cards:

This indicates the household uses one-third of its available credit, which is generally considered safe.

Q: What is credit utilization?

A: Credit utilization is the ratio of total credit card balances to total credit limits, expressed as a percentage.

Q: Why is credit utilization important?

A: It’s a key factor in credit scoring models. Lower utilization (below 30%) typically improves credit scores.

Q: How can I lower my credit utilization?

A: Pay down credit card balances, request higher credit limits, or spread spending across multiple cards to reduce the ratio.