Home

Home

Back

Back

Definition: This calculator computes the Cost of Goods Sold (COGS), which is the total direct cost incurred by a company to produce and sell goods during a specific period. It includes costs like raw materials, direct labor, and manufacturing overhead directly tied to production.

Purpose: It is used by businesses to determine their COGS, which is essential for calculating gross profit, analyzing profitability, managing inventory, setting pricing strategies, and reducing taxable income.

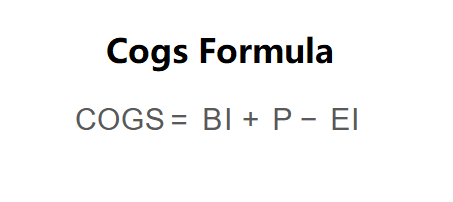

The calculator uses the following formula, as shown in the image above:

\( \text{COGS} = \text{BI} + \text{P} - \text{EI} \)

Where:

Steps:

Calculating the COGS is essential for:

Example 1: Calculate the COGS for a company with a beginning inventory of $50,000, purchases of $30,000 during the period, and an ending inventory of $20,000:

Example 2: Calculate the COGS for a company with a beginning inventory of $100,000, purchases of $50,000 during the period, and an ending inventory of $40,000:

Q: What costs are included in COGS?

A: COGS includes direct costs like raw materials, direct labor, and manufacturing overhead directly tied to production, but excludes indirect costs like marketing, distribution, or administrative expenses.

Q: How does COGS affect taxes?

A: COGS is a deductible business expense, reducing taxable income. A higher COGS lowers net income, which can decrease tax liability.

Q: Can COGS be calculated differently?

A: Yes, COGS can vary based on inventory valuation methods like FIFO (First-In, First-Out) or LIFO (Last-In, First-Out), which affect the cost of inventory sold and remaining.