Home

Home

Back

Back

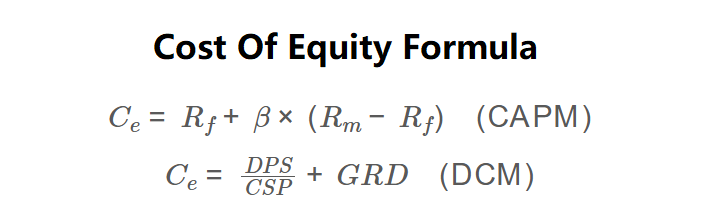

Definition: The Cost of Equity Calculator computes the rate of return a company must offer its equity investors to compensate for the risk of their investment. It uses either the Capital Asset Pricing Model (CAPM) for any stock or the Dividend Capitalization Model (DCM) for dividend-paying companies.

Purpose: Used by investors to assess the expected return on a stock and by companies to evaluate the cost of raising equity capital, aiding in investment decisions and financial planning.

The calculator uses two formulas:

\( C_e = R_f + \beta \times (R_m - R_f) \quad (\text{CAPM}) \)

\( C_e = \frac{DPS}{CSP} + GRD \quad (\text{DCM}) \)

Where:

Steps:

Calculating the cost of equity is essential for:

Example 1 (CAPM): Calculate the cost of equity for Walmart with \( R_f = 2.4\% \), \( \beta = 0.47 \), \( R_m = 8\% \):

Example 2 (DCM): Calculate the cost of equity for a company with \( DPS = \$2 \), \( CSP = \$70 \), \( GRD = 3\% \):

Q: What is the cost of equity?

A: The cost of equity (\( C_e \)) is the return a company must provide to equity investors to compensate for the risk of their investment, calculated using CAPM or DCM.

Q: When should I use the Dividend Capitalization Model?

A: Use DCM only for companies paying dividends, as it relies on \( DPS \), \( CSP \), and \( GRD \). For non-dividend stocks, use CAPM.

Q: How does CAPM account for risk?

A: CAPM uses \( \beta \) to measure a stock’s volatility relative to the market, adjusting the expected return based on systematic risk.