1. What is the Contribution Margin Calculator?

Definition: This calculator computes the contribution margin, which is the revenue remaining after deducting variable costs, available to cover fixed costs and contribute to profit. It provides the total contribution margin, contribution margin per unit, and contribution margin ratio.

Purpose: It is used by businesses to assess the profitability of products, make pricing decisions, evaluate product lines, and perform break-even analysis, helping to optimize financial performance and strategic planning.

2. How Does the Calculator Work?

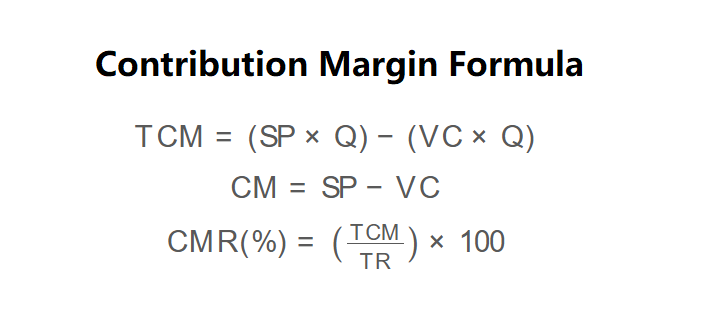

The calculator uses the following formulas, as shown in the image above:

\( \text{TCM} = (\text{SP} \times \text{Q}) - (\text{VC} \times \text{Q}) \)

\( \text{CM} = \text{SP} - \text{VC} \)

\( \text{CMR} (\%) = \left( \frac{\text{TCM}}{\text{TR}} \right) \times 100 \)

Where:

- \( \text{TCM} \): Total Contribution Margin ($);

- \( \text{CM} \): Contribution Margin per Unit ($/unit);

- \( \text{CMR} \): Contribution Margin Ratio (%);

- \( \text{SP} \): Selling Price per Unit ($);

- \( \text{VC} \): Variable Cost per Unit ($);

- \( \text{Q} \): Number of Units Sold;

- \( \text{TR} \): Total Revenue, where \( \text{TR} = \text{SP} \times \text{Q} \).

Steps:

- Enter the selling price per unit ($).

- Enter the variable cost per unit ($).

- Enter the number of units sold.

- Calculate the total contribution margin using the first formula.

- Calculate the contribution margin per unit using the second formula.

- Calculate the contribution margin ratio using the third formula.

- Display the results, formatted in scientific notation if the absolute value is less than 0.001, otherwise with 4 decimal places.

3. Importance of Contribution Margin Calculation

Calculating the contribution margin is essential for:

- Profitability Analysis: Determines how much each product contributes to covering fixed costs and generating profit, aiding in product line decisions.

- Pricing Decisions: Helps set optimal prices by ensuring variable costs are covered and fixed costs are met, maximizing profitability.

- Break-Even Analysis: Provides a foundation for calculating the break-even point, helping businesses determine the sales needed to cover all costs.

4. Using the Calculator

Example 1: Calculate the contribution margin for a company that sells 10,000 units of a product with a selling price of $50 per unit and a variable cost of $30 per unit:

- Selling Price per Unit (\( \text{SP} \)): $50;

- Variable Cost per Unit (\( \text{VC} \)): $30;

- Units Sold (\( \text{Q} \)): 10,000;

- Contribution Margin per Unit (\( \text{CM} \)): \( 50 - 30 = 20.0000 \text{ \$/unit} \);

- Total Contribution Margin (\( \text{TCM} \)): \( (50 \times 10,000) - (30 \times 10,000) = 500,000 - 300,000 = 200,000.0000 \text{ \$} \);

- Contribution Margin Ratio (\( \text{CMR} \)): \( (200,000 / (50 \times 10,000)) \times 100 = (200,000 / 500,000) \times 100 = 40.0000\% \).

Example 2: Calculate the contribution margin for a company that sells 5,000 units of a product with a selling price of $100 per unit and a variable cost of $40 per unit:

- Selling Price per Unit (\( \text{SP} \)): $100;

- Variable Cost per Unit (\( \text{VC} \)): $40;

- Units Sold (\( \text{Q} \)): 5,000;

- Contribution Margin per Unit (\( \text{CM} \)): \( 100 - 40 = 60.0000 \text{ \$/unit} \);

- Total Contribution Margin (\( \text{TCM} \)): \( (100 \times 5,000) - (40 \times 5,000) = 500,000 - 200,000 = 300,000.0000 \text{ \$} \);

- Contribution Margin Ratio (\( \text{CMR} \)): \( (300,000 / (100 \times 5,000)) \times 100 = (300,000 / 500,000) \times 100 = 60.0000\% \).

5. Frequently Asked Questions (FAQ)

Q: What is a good contribution margin ratio?

A: A good contribution margin ratio depends on the industry, but generally, a ratio above 60% is considered strong, indicating that a significant portion of revenue is available to cover fixed costs and generate profit.

Q: How can a business improve its contribution margin?

A: A business can improve its contribution margin by increasing the selling price, reducing variable costs (e.g., negotiating better supplier rates), or optimizing the product mix to focus on higher-margin items.

Q: How does contribution margin relate to break-even analysis?

A: The contribution margin per unit is used to calculate the break-even point in units by dividing total fixed costs by the contribution margin per unit, helping businesses determine the sales needed to cover all costs.

Contribution Margin Calculator© - All Rights Reserved 2025

Home

Home

Back

Back