1. What is the Compound Interest Calculator?

Definition: This calculator computes the Final Balance (\( B_{\text{final}} \)) and Interest Earned (\( I \)) for an investment or savings account based on the Initial Balance (\( B_0 \)), Interest Rate (\( r \)), Term (\( t \)), Compounding Frequency (\( n \)), and optional Periodic Deposit (\( D \)).

Purpose: Savers and investors use this tool to estimate the growth of their money over time, helping to plan for future financial goals or compare investment options.

2. How Does the Calculator Work?

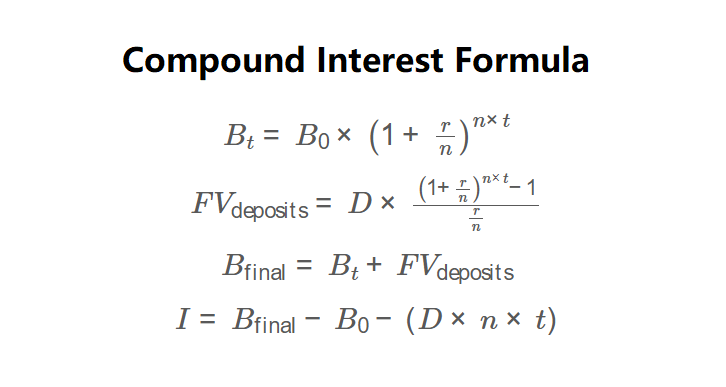

The calculator uses the following formulas, as shown in the image above:

\( B_t = B_0 \times \left(1 + \frac{r}{n}\right)^{n \times t} \)

\( FV_{\text{deposits}} = D \times \frac{\left(1 + \frac{r}{n}\right)^{n \times t} - 1}{\frac{r}{n}} \)

\( B_{\text{final}} = B_t + FV_{\text{deposits}} \)

\( I = B_{\text{final}} - B_0 - (D \times n \times t) \)

Where:

- \( B_0 \): Initial Balance (in selected currency);

- \( r \): Annual Interest Rate (as a decimal, e.g., 5% = 0.05);

- \( t \): Term (converted to years);

- \( n \): Number of times interest is compounded per year;

- \( D \): Periodic Deposit per compounding period (optional, in selected currency);

- \( B_{\text{final}} \): Final Balance (in selected currency);

- \( I \): Interest Earned (in selected currency).

Steps:

- Enter the Initial Balance (\( B_0 \)) and select the currency (USD, EUR, GBP, JPY).

- Enter the Interest Rate (\( r \)) in percentage (e.g., 5 for 5%).

- Enter the Term (\( t \)) and select its unit (Daily, Monthly, Yearly).

- Select the Compounding Frequency (\( n \)) from the options: Annually (1), Quarterly (4), Monthly (12), or Daily (365).

- Optionally, enter the Periodic Deposit (\( D \)) made at the end of each compounding period.

- The calculator converts the term to years, converts the interest rate to a decimal, computes the Final Balance, and then calculates the Interest Earned.

- Results are formatted (scientific notation for values < 0.001, otherwise 4 decimal places) and displayed in the selected currency.

3. Importance of Compound Interest Calculation

Calculating compound interest is essential for:

- Financial Planning: Helps predict the future value of savings or investments for budgeting or goal-setting.

- Investment Growth: Estimates the growth of accounts with regular contributions, aiding in choosing the best savings or investment options.

- Understanding Compounding: Shows the power of compounding over time, encouraging long-term saving habits.

4. Using the Calculator

Example 1: Calculate the Final Balance and Interest Earned for an account with an Initial Balance of $5,000, an Interest Rate of 4%, a Term of 3 years, monthly compounding, and no periodic deposits, in USD:

- Initial Balance (\( B_0 \)): $5,000;

- Interest Rate (\( r \)): 4% = 0.04;

- Term (\( t \)): 3 years;

- Compounding Frequency (\( n \)): Monthly = 12;

- Periodic Deposit (\( D \)): $0;

- Final Balance (\( B_{\text{final}} \)):

- \( 5,000 \times \left(1 + \frac{0.04}{12}\right)^{12 \times 3} = 5,000 \times (1 + 0.003333)^{36} = 5,000 \times 1.1273 = 5,636.6772 \, \text{USD} \);

- Interest Earned (\( I \)):

- \( 5,636.6772 - 5,000 = 636.6772 \, \text{USD} \).

Example 2: Calculate the Final Balance and Interest Earned for an account with an Initial Balance of €1,000, an Interest Rate of 2%, a Term of 24 months, quarterly compounding, and a periodic deposit of €100 per quarter, in EUR:

- Initial Balance (\( B_0 \)): €1,000;

- Interest Rate (\( r \)): 2% = 0.02;

- Term (\( t \)): 24 months = \( 24 \div 12 = 2 \) years;

- Compounding Frequency (\( n \)): Quarterly = 4;

- Periodic Deposit (\( D \)): €100 per quarter;

- Balance from Initial:

- \( B_t = 1,000 \times \left(1 + \frac{0.02}{4}\right)^{4 \times 2} = 1,000 \times (1 + 0.005)^8 = 1,000 \times 1.0407 = 1,040.7070 \, \text{EUR} \);

- Future Value of Deposits:

- \( FV_{\text{deposits}} = 100 \times \frac{\left(1 + \frac{0.02}{4}\right)^{4 \times 2} - 1}{\frac{0.02}{4}} = 100 \times \frac{(1.005)^8 - 1}{0.005} = 100 \times \frac{0.0407}{0.005} = 100 \times 8.1408 = 814.0800 \, \text{EUR} \);

- Final Balance (\( B_{\text{final}} \)):

- \( 1,040.7070 + 814.0800 = 1,854.7870 \, \text{EUR} \);

- Total Deposits: \( 100 \times 4 \times 2 = 800 \, \text{EUR} \);

- Interest Earned (\( I \)):

- \( 1,854.7870 - 1,000 - 800 = 54.7870 \, \text{EUR} \).

5. Frequently Asked Questions (FAQ)

Q: Why does compounding frequency matter?

A: More frequent compounding increases the effective interest rate, leading to higher returns over the same term.

Q: Can the interest rate be negative?

A: While rare, negative interest rates can occur in certain economic conditions. The calculator allows this, but it’s not typical for savings accounts.

Q: What if I don’t make periodic deposits?

A: If no periodic deposits are made (\( D = 0 \)), the calculator computes the growth based solely on the Initial Balance and interest rate.

Compound Interest Calculator© - All Rights Reserved 2025

Home

Home

Back

Back