Home

Home

Back

Back

Definition: This calculator computes the annual (T) and monthly (M) rent for a commercial lease based on the area and rental rate, with optional splits for base rent and operational expenses. It also calculates the rental agent's fee (F).

Purpose: Helps business owners estimate leasing costs, plan budgets, and understand agent fees, aiding in negotiations and financial planning for commercial spaces.

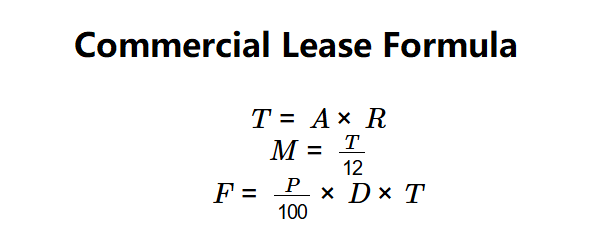

The calculator uses these formulas:

Formulas:

Steps:

Calculating commercial lease costs is key for:

Example: For a commercial space with \( A = 2,000 \) ft², \( R = \$30 \)/ft², \( B = \$20 \)/ft², \( O = \$10 \)/ft², \( P = 5\% \), \( D = 3 \) years:

This shows the business pays $60,000/year ($5,000/month) in rent, with a $9,000 agent fee over 3 years.

Q: How is commercial rent calculated?

A: Commercial rent is calculated using \( T = A \times R \), multiplying the total area (\( A \)) by the rental rate (\( R \)). The rate may split into base rent (\( B \)) and operational expenses (\( O \)), where \( R = B + O \). Monthly rent is \( M = \frac{T}{12} \).

Q: How is the rental agent’s fee calculated?

A: The agent’s fee is calculated as \( F = \frac{P}{100} \times D \times T \), using a percentage (\( P \)) of the annual rent (\( T \)) over the lease duration (\( D \)). Typically paid by the landlord, it may be split (e.g., 50% at move-in, 50% at move-out).

Q: What are operational expenses?

A: Operational expenses include costs like utilities, maintenance, insurance, or property taxes, often passed to tenants in commercial leases (e.g., triple net leases).