Home

Home

Back

Back

Definition: This calculator computes the churn rate, which is the percentage of customers who stop using a company's services over a specified period, and the customer lifetime, which is the average time a customer stays with the company before leaving.

Purpose: It is used by businesses to assess customer retention, understand the financial impact of losing customers, and estimate how long customers typically stay, aiding in strategic planning and customer experience improvements.

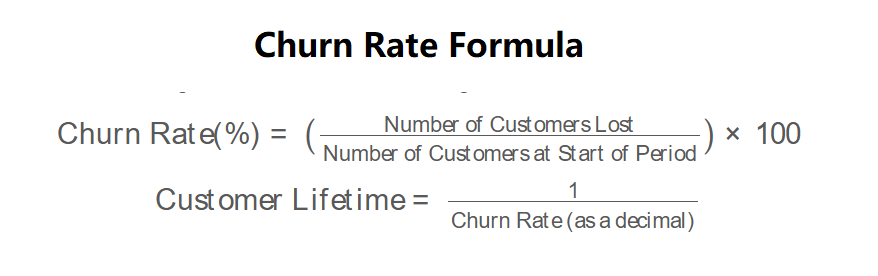

The calculator uses the following formulas, as shown in the image above:

\( \text{Churn Rate} (\%) = \left( \frac{\text{Number of Customers Lost}}{\text{Number of Customers at Start of Period}} \right) \times 100 \)

\( \text{Customer Lifetime} = \frac{1}{\text{Churn Rate (as a decimal)}} \)

Where:

Steps:

Calculating the churn rate and customer lifetime is essential for:

Example 1: Calculate the monthly churn rate and customer lifetime for a company with 400 customers at the start of the month and 90 customers lost during the month:

Example 2: Calculate the yearly churn rate and customer lifetime for a company with 1,000 customers at the start of the year and 200 customers lost during the year:

Q: What is a good churn rate?

A: A good churn rate depends on the industry, but ideally, it should be as close to 0% as possible. For SaaS companies, a monthly churn rate below 5% is generally considered good, while B2B companies might aim for an annual churn rate below 10%.

Q: How can a company reduce its churn rate?

A: Companies can reduce churn by improving customer experience, offering loyalty programs, providing excellent customer support, addressing feedback, and ensuring the product meets customer needs.

Q: Why is customer lifetime important?

A: Customer lifetime helps businesses estimate the long-term value of a customer, forecast revenue, and justify investments in customer acquisition and retention strategies.