Home

Home

Back

Back

Definition: This calculator computes the cash ratio (\( CR \)), which measures a company's ability to cover its current liabilities with its cash and cash equivalents, indicating short-term liquidity.

Purpose: Helps businesses, investors, and creditors assess a company's immediate liquidity and ability to meet short-term obligations without relying on other assets.

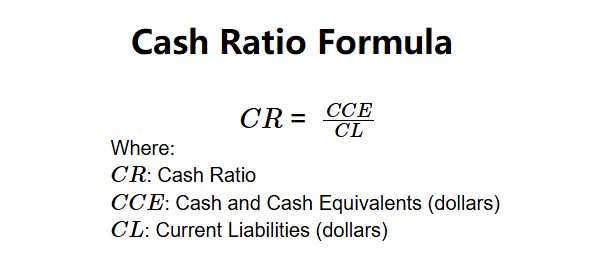

The calculator uses a simple formula to compute the cash ratio:

Formula:

Steps:

Calculating the cash ratio is crucial for:

Example 1: \( CCE = \$14,400,000 \), \( CL = \$12,000,000 \):

A cash ratio of 1.20x indicates the company can cover its current liabilities 1.2 times with cash and equivalents.

Example 2: \( CCE = \$5,000,000 \), \( CL = \$10,000,000 \):

A cash ratio of 0.50x suggests limited liquidity to cover current liabilities.

Example 3: \( CCE = \$20,000,000 \), \( CL = \$8,000,000 \):

A cash ratio of 2.50x indicates strong liquidity to cover current liabilities.

Q: What is the cash ratio?

A: The cash ratio (\( CR \)) measures a company's ability to pay off its current liabilities (\( CL \)) using only cash and cash equivalents (\( CCE \)).

Q: What is a good cash ratio?

A: A \( CR \) above 1 indicates sufficient cash to cover liabilities, while a ratio below 1 may suggest liquidity challenges.

Q: Can the cash ratio be negative?

A: No, since \( CCE \) and \( CL \) are typically non-negative, \( CR \) is non-negative.