Home

Home

Back

Back

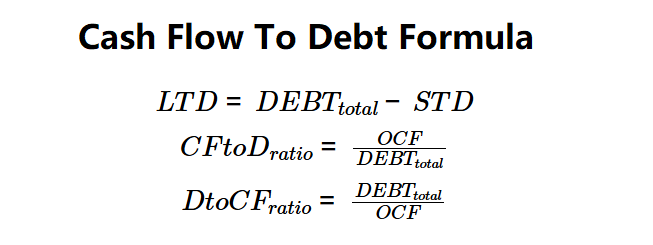

Definition: This calculator computes the cash flow to debt ratio (\( CFtoD_{ratio} \)), which measures a company's ability to cover its total debt with its operating cash flow, and the debt to cash flow ratio (\( DtoCF_{ratio} \)), which indicates how many years it would take to repay debt with current cash flow. It also calculates long-term debt (\( LTD \)).

Purpose: Helps investors, creditors, and businesses assess debt repayment capacity, financial stability, and make informed financing decisions.

The calculator uses a three-step process to compute the results:

Formulas:

Steps:

Calculating these ratios is crucial for:

Example 1: \( OCF = \$500,000 \), \( DEBT_{total} = \$500,000 \), \( STD = \$200,000 \):

A \( CFtoD_{ratio} \) of 1.0000 indicates full debt coverage, and a \( DtoCF_{ratio} \) of 1.0000 suggests debt repayment in one year.

Example 2: \( OCF = \$750,000 \), \( DEBT_{total} = \$500,000 \), \( STD = \$100,000 \):

A high \( CFtoD_{ratio} \) and low \( DtoCF_{ratio} \) suggest strong debt coverage and faster repayment potential.

Example 3: \( OCF = \$200,000 \), \( DEBT_{total} = \$400,000 \), \( STD = \$150,000 \):

A low \( CFtoD_{ratio} \) and high \( DtoCF_{ratio} \) indicate weaker debt coverage, suggesting potential financial strain.

Q: What is the cash flow to debt ratio?

A: The cash flow to debt ratio (\( CFtoD_{ratio} \)) measures how well a company's operating cash flow (\( OCF \)) covers its total debt (\( DEBT_{total} \)).

Q: What is the debt to cash flow ratio?

A: The debt to cash flow ratio (\( DtoCF_{ratio} \)) indicates how many years it would take to repay total debt with current operating cash flow.

Q: Can these ratios be negative?

A: Yes, if \( OCF \) is negative, both ratios can be negative, indicating potential liquidity issues.