1. What is the Cash Conversion Cycle Calculator?

Definition: This calculator computes the cash conversion cycle (\( CCC \)), which measures the time (in days) a company takes to convert its investments in inventory and receivables into cash, minus the time it takes to pay its suppliers.

Purpose: Helps businesses assess working capital efficiency, optimize cash flow, and improve liquidity management.

2. How Does the Calculator Work?

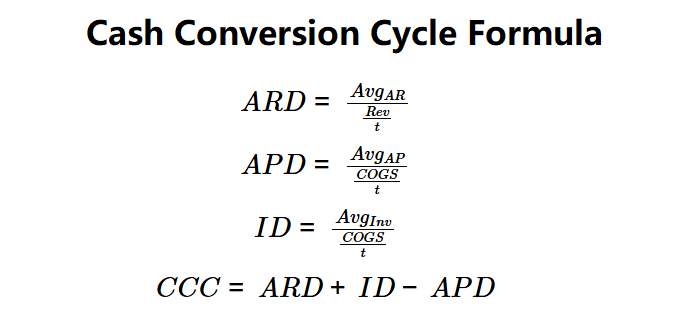

The calculator computes the cash conversion cycle using the following formulas:

Formulas:

\( ARD = \frac{Avg_{AR}}{\frac{Rev}{t}} \)

\( APD = \frac{Avg_{AP}}{\frac{COGS}{t}} \)

\( ID = \frac{Avg_{Inv}}{\frac{COGS}{t}} \)

\( CCC = ARD + ID - APD \)

Where:

- \( CCC \): Cash Conversion Cycle (days)

- \( ARD \): Accounts Receivables Days (days)

- \( APD \): Accounts Payable Days (days)

- \( ID \): Inventory Days (days)

- \( Avg_{AR} \): Average Accounts Receivables (dollars)

- \( Avg_{AP} \): Average Accounts Payable (dollars)

- \( Avg_{Inv} \): Average Inventory (dollars)

- \( Rev \): Total Revenues (dollars)

- \( COGS \): Cost of Goods Sold (dollars)

- \( t \): Period of Analysis (days)

Steps:

- Step 1: Calculate days. Compute \( ARD \), \( APD \), and \( ID \) using average values and daily revenues/COGS.

- Step 2: Calculate \( CCC \). Sum \( ARD \) and \( ID \), then subtract \( APD \).

3. Importance of Cash Conversion Cycle Calculation

Calculating the cash conversion cycle is crucial for:

- Working Capital Management: A shorter \( CCC \) indicates faster cash recovery, improving liquidity.

- Operational Efficiency: Identifies bottlenecks in inventory, receivables, or payables processes.

- Financial Planning: Assists in forecasting cash flow needs and optimizing payment terms.

4. Using the Calculator

Example 1:

\( Avg_{AR} = \$55,000 \), \( Avg_{AP} = \$35,000 \), \( Avg_{Inv} = \$110,000 \),

\( Rev = \$1,000,000 \), \( COGS = \$600,000 \), \( t = 365 \):

- Step 1: \( ARD = \frac{55,000}{\frac{1,000,000}{365}} \approx 20.08 \) days,

\( APD = \frac{35,000}{\frac{600,000}{365}} \approx 21.29 \) days,

\( ID = \frac{110,000}{\frac{600,000}{365}} \approx 66.92 \) days.

- Step 2: \( CCC = 20.08 + 66.92 - 21.29 \approx 65.71 \) days.

- Results: \( ARD = 20.08 \) days, \( APD = 21.29 \) days, \( ID = 66.92 \) days,

\( CCC = 65.71 \) days.

A CCC of 65.71 days indicates the time to convert investments into cash.

Example 2:

\( Avg_{AR} = \$85,000 \), \( Avg_{AP} = \$55,000 \), \( Avg_{Inv} = \$190,000 \),

\( Rev = \$2,000,000 \), \( COGS = \$1,200,000 \), \( t = 365 \):

- Step 1: \( ARD = \frac{85,000}{\frac{2,000,000}{365}} \approx 15.51 \) days,

\( APD = \frac{55,000}{\frac{1,200,000}{365}} \approx 16.74 \) days,

\( ID = \frac{190,000}{\frac{1,200,000}{365}} \approx 57.79 \) days.

- Step 2: \( CCC = 15.51 + 57.79 - 16.74 \approx 56.56 \) days.

- Results: \( ARD = 15.51 \) days, \( APD = 16.74 \) days, \( ID = 57.79 \) days,

\( CCC = 56.56 \) days.

A shorter CCC of 56.56 days suggests improved cash flow efficiency.

5. Frequently Asked Questions (FAQ)

Q: What is the cash conversion cycle?

A: The cash conversion cycle (\( CCC \)) measures the days it takes for a company to convert its investments in inventory and receivables into cash, minus the days it takes to pay suppliers.

Q: Why is a shorter CCC better?

A: A shorter \( CCC \) indicates faster cash recovery, improving liquidity and reducing the need for external financing.

Q: Can the CCC be negative?

A: Yes, if \( APD \) exceeds the sum of \( ARD \) and \( ID \), the \( CCC \) can be negative, indicating highly efficient cash management.

Cash Conversion Cycle Calculator© - All Rights Reserved 2025

Home

Home

Back

Back