1. What is the Carried Interest Calculator?

Definition: The Carried Interest Calculator computes the performance fee (carried interest) earned by investment fund managers based on the fund’s returns above a minimum threshold (hurdle rate). It also calculates the fund return and, optionally, the general partner (GP) catch-up distribution, which allows managers to receive a larger share of profits until a target percentage is reached.

Purpose: Used by private equity, hedge fund, and venture capital professionals to estimate the compensation fund managers earn from successful investments, helping investors and managers understand profit-sharing structures.

2. How Does the Calculator Work?

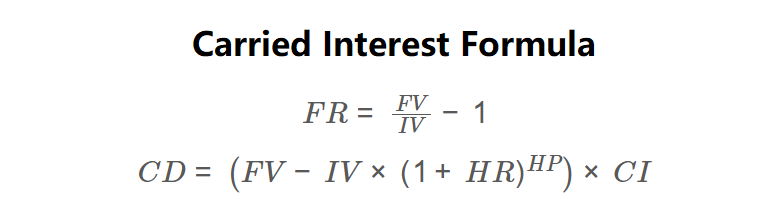

The calculator uses the following formulas:

\( FR = \frac{FV}{IV} - 1 \)

\( CD = \left( FV - IV \times (1 + HR)^{HP} \right) \times CI \)

Where:

- \( IV \): Initial Fund Value ($);

- \( FV \): Final Fund Value ($);

- \( HP \): Hold Period (years);

- \( HR \): Hurdle Rate (%);

- \( CI \): Carried Interest (%);

- \( FR \): Fund Return (%);

- \( CD \): Carry Distribution ($).

Steps:

- Enter the initial fund value in dollars (e.g., $10,000,000).

- Enter the final fund value in dollars (e.g., $20,000,000).

- Enter the hold period in years (e.g., 5).

- Enter the hurdle rate as a percentage (e.g., 5).

- Enter the carried interest as a percentage (e.g., 20).

- Optionally enable the GP catch-up provision.

- Calculate the fund return: \( \frac{FV}{IV} - 1 \).

- Calculate the hurdle value: \( IV \times (1 + HR)^{HP} \).

- Compute the carry distribution: \( (FV - \text{Hurdle Value}) \times CI \). If negative, display $0.00.

- If GP catch-up is enabled, calculate the catch-up distribution (up to 20% of total profits).

- Display the fund return (%), carry distribution ($), and GP catch-up distribution ($), formatted appropriately.

3. Importance of Carried Interest Calculation

Calculating carried interest is essential for:

- Fund Manager Compensation: Quantifies the performance-based earnings of fund managers, aligning their incentives with investor returns.

- Investor Transparency: Helps investors understand how profits are shared and the impact of fees on their returns.

- Fund Performance Evaluation: The fund return and carry distribution indicate the fund’s success relative to the hurdle rate.

4. Using the Calculator

Example 1: Calculate the carried interest for Fund Alpha with \( IV = \$10,000,000 \), \( FV = \$20,000,000 \), \( HP = 5 \), \( HR = 5\% \), \( CI = 20\% \), and GP catch-up disabled:

- \( IV \): $10,000,000;

- \( FV \): $20,000,000;

- \( FR \): \( \frac{20,000,000}{10,000,000} - 1 = 100\% \);

- \( \text{Hurdle Value} \): \( 10,000,000 \times (1 + 0.05)^5 \approx 12,762,815.63 \);

- \( CD \): \( (20,000,000 - 12,762,815.63) \times 0.20 = 1,447,436.87 \);

- \( CUD \): $0.00 (disabled).

Result: Fund Return = 100.0000%, Carry Distribution = $1,447,436.87, GP Catch-Up = $0.00.

Example 2: Calculate the carried interest with GP catch-up enabled for a fund with \( IV = \$5,000,000 \), \( FV = \$8,000,000 \), \( HP = 3 \), \( HR = 6\% \), \( CI = 15\% \):

- \( IV \): $5,000,000;

- \( FV \): $8,000,000;

- \( FR \): \( \frac{8,000,000}{5,000,000} - 1 = 60\% \);

- \( \text{Hurdle Value} \): \( 5,000,000 \times (1 + 0.06)^3 \approx 5,955,080 \);

- \( CD \): \( (8,000,000 - 5,955,080) \times 0.15 = 306,738 \);

- \( CUD \): Total profit = \( 8,000,000 - 5,000,000 = 3,000,000 \); Target = \( 0.20 \times 3,000,000 = 600,000 \); Catch-Up = \( \min(2,044,920, 600,000) = 600,000 \).

Result: Fund Return = 60.0000%, Carry Distribution = $306,738.00, GP Catch-Up = $600,000.00.

5. Frequently Asked Questions (FAQ)

Q: What is carried interest?

A: Carried interest (\( CI \)) is a performance fee paid to fund managers, typically a percentage of profits above the hurdle rate (\( HR \)), incentivizing strong fund performance.

Q: What is the GP catch-up provision?

A: The GP catch-up (\( CUD \)) allows general partners to receive a larger share of profits after the hurdle rate is met until they reach a predetermined profit share (e.g., 20% of total profits).

Q: Why is the carry distribution zero if the fund return is below the hurdle rate?

A: If \( FV < IV \times (1 + HR)^{HP} \), no carried interest is paid, as the fund did not meet the minimum required return.

Carried Interest Calculator© - All Rights Reserved 2025

Home

Home

Back

Back