Home

Home

Back

Back

Definition: This calculator computes the Capitalization Rate (C) for a real estate investment, measuring the annual return based on net rental income (N) relative to property value (V).

Purpose: Helps investors evaluate the profitability and risk of rental properties, compare investment opportunities, and assess market conditions.

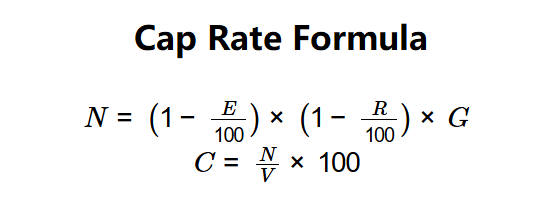

The calculator uses these formulas:

Formulas:

Steps:

Calculating cap rate is key for:

Example: For a property with \( V = \$200,000 \), \( G = \$30,000 \), \( R = 2\% \), \( E = 20\% \):

This shows the property yields a 11.76% annual return based on its net income and value.

Q: How is cap rate calculated?

A: Cap rate is calculated in two steps: (1) Compute net rental income using \( N = \left(1 - \frac{E}{100}\right) \times \left(1 - \frac{R}{100}\right) \times G \), adjusting gross income (\( G \)) for operating expenses (\( E \)) and vacancy rate (\( R \)); (2) Divide net income by property value and multiply by 100: \( C = \frac{N}{V} \times 100 \).

Q: What is a good cap rate?

A: A good cap rate depends on market conditions and investor goals. Typically, 4–6% is considered low risk (stable markets), while 8–12% indicates higher risk but higher returns. Local market data should guide expectations.

Q: What expenses are included in operating expenses?

A: Operating expenses include property management fees, maintenance, insurance, property taxes, and utilities, but exclude mortgage payments or capital expenditures.