1. What is the Call Option Profit Calculator?

Definition: This calculator computes the total cost, potential profit percentage, and potential return in dollars for a long call option strategy, helping investors evaluate the profitability of buying call options.

Purpose: Assists traders and investors in assessing the financial outcomes of a bullish options strategy, aiding in decision-making and risk assessment.

2. How Does the Calculator Work?

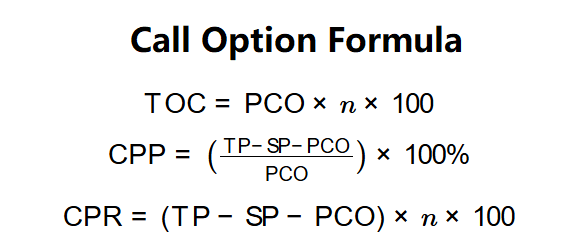

The calculator uses the following formulas to compute results:

Formulas:

\( \text{TOC} = \text{PCO} \times n \times 100 \)

\( \text{CPP} = \left( \frac{\text{TP} - \text{SP} - \text{PCO}}{\text{PCO}} \right) \times 100\% \)

\( \text{CPR} = (\text{TP} - \text{SP} - \text{PCO}) \times n \times 100 \)

Where:

- \( \text{TP} \): Target price of the stock (dollars)

- \( \text{SP} \): Strike price of the option (dollars)

- \( \text{PCO} \): Price of the call option (dollars)

- \( n \): Number of option contracts (each contract contains 100 options)

- \( \text{TOC} \): Total option cost (dollars)

- \( \text{CPP} \): Call potential profit (percentage)

- \( \text{CPR} \): Call potential return (dollars)

Steps:

- Step 1: Input parameters. Enter the target price (\( \text{TP} \)), strike price (\( \text{SP} \)), call option price (\( \text{PCO} \)), and number of contracts (\( n \)).

- Step 2: Calculate TOC. Multiply the option price by the number of contracts and 100 (options per contract).

- Step 3: Calculate CPP. Compute the profit percentage using the formula provided.

- Step 4: Calculate CPR. Compute the return in dollars using the formula provided.

3. Importance of Call Option Profit Calculation

Calculating call option profits is crucial for:

- Profitability Assessment: Helps investors estimate potential gains from a bullish strategy.

- Risk Evaluation: Allows traders to weigh the cost of options against potential returns.

- Strategic Planning: Enables comparison of different strike prices or target prices to optimize trading decisions.

4. Using the Calculator

Example: \( \text{TP} = \$82.40 \), \( \text{SP} = \$70.00 \), \( \text{PCO} = \$7.50 \), \( n = 4 \):

- Step 1: Input \( \text{TP} = 82.40 \), \( \text{SP} = 70.00 \), \( \text{PCO} = 7.50 \), \( n = 4 \).

- Step 2: Calculate TOC: \( 7.50 \times 4 \times 100 = \$3000.00 \).

- Step 3: Calculate CPP: \( \left( \frac{82.40 - 70.00 - 7.50}{7.50} \right) \times 100\% \approx 65.33\% \).

- Step 4: Calculate CPR: \( (82.40 - 70.00 - 7.50) \times 4 \times 100 = \$1960.00 \).

- Results: TOC = \$3000.00, CPP = 65.33%, CPR = \$1960.00.

These results indicate a significant potential profit if the stock reaches the target price.

5. Frequently Asked Questions (FAQ)

Q: What does the CPP percentage mean?

A: It represents the percentage return on the option cost if the stock reaches the target price.

Q: Why multiply by 100 for the number of options?

A: Each option contract typically represents 100 shares of the underlying stock.

Q: Can this calculator be used for put options?

A: No, this calculator is designed for call options. Put options require different formulas.

Call Option Profit Calculator© - All Rights Reserved 2025

Home

Home

Back

Back