Home

Home

Back

Back

Definition: The CPI Inflation Calculator computes the cumulative and average percentage change in the Consumer Price Index (CPI) between two years, indicating the overall and annualized inflation rates over the period. CPI data includes years from 1913 to May 2025.

Purpose: Helps individuals, businesses, and policymakers understand how inflation affects purchasing power, aiding in financial planning, wage adjustments, and economic analysis.

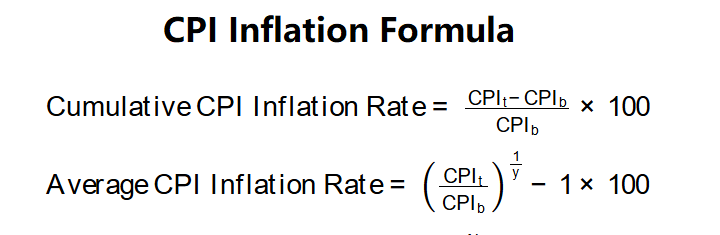

The calculator uses the CPI to compute inflation rates, following these formulas and steps:

Formulas:

Steps:

Calculating CPI inflation rates is crucial for:

Example: Base Year: 2017, \( \text{CPI}_{\text{b}} = 142.86 \); Target Year: 2018, \( \text{CPI}_{\text{t}} = 185.71 \):

From 2017 to 2018, the general price level increased by 30.05%, indicating significant inflation over one year.

Q: What is CPI inflation?

A: CPI inflation measures the percentage change in the Consumer Price Index, reflecting the change in the general price level over time.

Q: What’s the difference between cumulative and average inflation rates?

A: Cumulative inflation measures the total price change over a period; average inflation annualizes this change, showing the yearly rate needed to achieve the total change.

Q: Can CPI inflation be negative?

A: Yes, a negative rate (deflation) occurs when the target year CPI is lower than the base year CPI, indicating falling prices.