1. What is the Certificate of Deposit (CD) Calculator?

Definition: This calculator computes the Final Balance (\( D_1 \)) and Interest Earned (\( I \)) for a Certificate of Deposit (CD) based on the Initial Deposit (\( D_0 \)), Interest Rate (\( r \)), Term (\( t \)), and Compounding Frequency (\( n \)). A CD is a savings product that earns interest over a fixed term.

Purpose: Savers and investors use this tool to estimate the growth of their money in a CD, helping to plan for future financial goals or compare CD options.

2. How Does the Calculator Work?

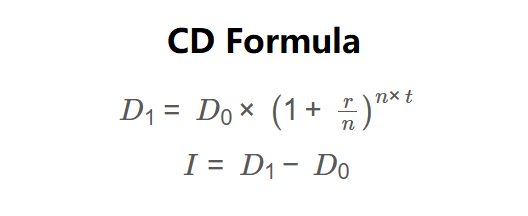

The calculator uses the following formulas, as shown in the image above:

\( D_1 = D_0 \times \left(1 + \frac{r}{n}\right)^{n \times t} \)

\( I = D_1 - D_0 \)

Where:

- \( D_0 \): Initial Deposit (in selected currency);

- \( r \): Annual Interest Rate (as a decimal, e.g., 5% = 0.05);

- \( t \): Term (converted to years);

- \( n \): Number of times interest is compounded per year;

- \( D_1 \): Final Balance (in selected currency);

- \( I \): Interest Earned (in selected currency).

Steps:

- Enter the Initial Deposit (\( D_0 \)) and select the currency (USD, EUR, GBP, JPY).

- Enter the Interest Rate (\( r \)) in percentage (e.g., 5 for 5%).

- Enter the Term (\( t \)) and select its unit (Daily, Monthly, Yearly).

- Select the Compounding Frequency (\( n \)) from the options: Annually (1), Quarterly (4), Monthly (12), or Daily (365).

- The calculator converts the term to years, converts the interest rate to a decimal, computes the Final Balance, and then calculates the Interest Earned.

- Results are formatted (scientific notation for values < 0.001, otherwise 4 decimal places) and displayed in the selected currency.

3. Importance of CD Calculation

Calculating the Final Balance and Interest Earned for a CD is essential for:

- Financial Planning: Helps predict the future value of savings for budgeting or goal-setting.

- Investment Comparison: Allows comparison of different CD options based on interest rates and terms.

- Return Estimation: Provides a clear picture of earnings, aiding in decisions about locking money in a CD.

4. Using the Calculator

Example 1: Calculate the Final Balance and Interest Earned for a CD with an Initial Deposit of $10,000, an Interest Rate of 3%, a Term of 2 years, and monthly compounding, in USD:

- Initial Deposit (\( D_0 \)): $10,000;

- Interest Rate (\( r \)): 3% = 0.03;

- Term (\( t \)): 2 years;

- Compounding Frequency (\( n \)): Monthly = 12;

- Final Balance (\( D_1 \)): \( 10,000 \times \left(1 + \frac{0.03}{12}\right)^{12 \times 2} = 10,000 \times (1 + 0.0025)^{24} = 10,000 \times 1.0618 = 10,617.76 \, \text{USD} \);

- Interest Earned (\( I \)): \( 10,617.76 - 10,000 = 617.7600 \, \text{USD} \).

Example 2: Calculate the Final Balance and Interest Earned for a CD with an Initial Deposit of €5,000, an Interest Rate of 2%, a Term of 36 months, and quarterly compounding, in EUR:

- Initial Deposit (\( D_0 \)): €5,000;

- Interest Rate (\( r \)): 2% = 0.02;

- Term (\( t \)): 36 months = \( 36 \div 12 = 3 \) years;

- Compounding Frequency (\( n \)): Quarterly = 4;

- Final Balance (\( D_1 \)): \( 5,000 \times \left(1 + \frac{0.02}{4}\right)^{4 \times 3} = 5,000 \times (1 + 0.005)^{12} = 5,000 \times 1.0617 = 5,308.54 \, \text{EUR} \);

- Interest Earned (\( I \)): \( 5,308.54 - 5,000 = 308.5400 \, \text{EUR} \).

5. Frequently Asked Questions (FAQ)

Q: What happens if I withdraw my CD early?

A: This calculator assumes the CD is held to maturity. Early withdrawal may incur penalties, reducing the final balance and interest earned.

Q: Why does compounding frequency matter?

A: More frequent compounding increases the effective interest rate, leading to higher returns over the same term.

Q: Can the interest rate be negative?

A: While rare, negative interest rates can occur in certain economic conditions. The calculator allows this, but it’s not typical for CDs.

Certificate of Deposit (CD) Calculator© - All Rights Reserved 2025

Home

Home

Back

Back