Home

Home

Back

Back

Definition: The CAPM (Capital Asset Pricing Model) Calculator computes the expected return of an asset based on its systematic risk (beta) relative to the market. It also calculates the risk premium of the asset, which is the additional return over the risk-free rate due to market risk exposure. CAPM quantifies the risk-return relationship, aiding in investment evaluation.

Purpose: Used by investors and financial analysts to estimate an asset’s expected return and risk premium, evaluate investment opportunities, and determine the cost of equity for corporate finance decisions, such as capital budgeting or stock valuation.

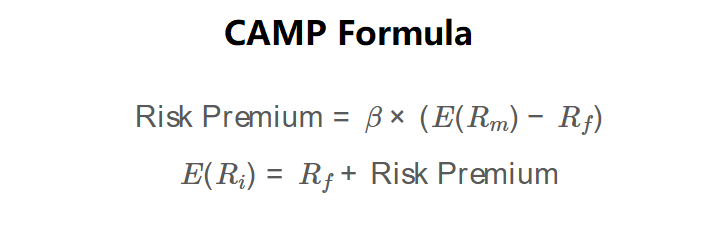

The calculator uses the following formulas:

\( \text{Risk Premium} = \beta \times (E(R_m) - R_f) \)

\( E(R_i) = R_f + \text{Risk Premium} \)

Where:

Steps:

Calculating the CAPM and risk premium is essential for:

Example 1: Calculate the risk premium and expected return for a stock with a risk-free rate of 3%, a beta of 4, and an expected market return of 9%:

Example 2: Calculate the risk premium and expected return for Walmart stock with a risk-free rate of 2.4%, a beta of 0.47, and an expected market return of 8%:

Q: What is the risk premium of the asset?

A: The risk premium of the asset is the additional return over the risk-free rate due to the asset’s exposure to market risk, calculated as \( \beta \times (E(R_m) - R_f) \).

Q: How does CAPM differ from the Sharpe Ratio?

A: CAPM estimates the expected return and risk premium based on systematic risk (beta) and market risk premium, focusing on market risk. The Sharpe Ratio measures excess return per unit of total risk (standard deviation), evaluating overall risk-adjusted performance.

Q: What is a good expected return or risk premium?

A: A good expected return or risk premium depends on the investor’s risk tolerance. High-beta assets (e.g., >1) should have higher risk premiums and expected returns to compensate for risk, while low-beta assets (e.g., <1) offer lower but more stable returns.