Home

Home

Back

Back

Definition: This calculator computes the Final Value (\( FV \)) of an investment or asset based on its Initial Value (\( IV \)), Compound Annual Growth Rate (\( R \)), and Number of Periods (\( T \)). \( R \) represents the annual growth rate of an investment over a specified period, assuming the growth happens steadily.

Purpose: Investors, financial analysts, and business owners use this tool to estimate the future value of investments, such as stocks, portfolios, or business revenues, to aid in financial planning and decision-making.

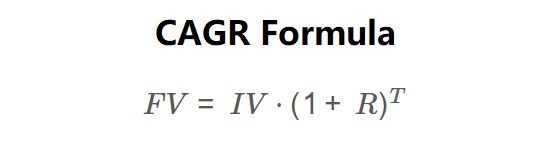

The calculator uses the following formula to compute the Final Value:

\( FV = IV \cdot (1 + R)^{T} \)

Where:

Steps:

Calculating the Final Value using CAGR is essential for:

Example 1: Calculate the Final Value of an investment with an \( IV \) of $10,000, an \( R \) of 8%, and a \( T \) of 5 years, in USD:

Example 2: Calculate the Final Value of a portfolio with an \( IV \) of €20,000, an \( R \) of 6%, and a \( T \) of 60 months, in EUR:

Q: How accurate is the Final Value calculation using CAGR?

A: The formula assumes a constant growth rate, which may not reflect real-world fluctuations. It provides a good estimate for steady growth scenarios.

Q: Can CAGR be negative?

A: Yes, a negative \( R \) indicates a decline in value over the period. The calculator will compute the Final Value accordingly.

Q: Why are there multiple time units for the periods?

A: Different users prefer different time scales (e.g., monthly for short-term investments, yearly for long-term goals). The calculator converts all periods to years for consistency in calculation.