Home

Home

Back

Back

Definition: This calculator computes the cash burn rate, which is the rate at which a company spends its cash reserves over a specified period, and the cash runway, which is the time left before the company runs out of cash at the current burn rate.

Purpose: It is used by startups, small businesses, and companies with limited cash reserves to monitor their cash expenditure, plan fundraising, and ensure financial sustainability by understanding how long their cash will last.

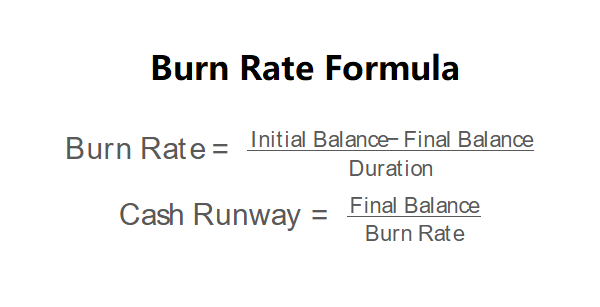

The calculator uses the following formulas, as shown in the image above:

\( \text{Burn Rate} = \frac{\text{Initial Balance} - \text{Final Balance}}{\text{Duration}} \)

\( \text{Cash Runway} = \frac{\text{Final Balance}}{\text{Burn Rate}} \)

Where:

Steps:

Calculating the burn rate and cash runway is essential for:

Example 1: Calculate the burn rate and cash runway for a company with an initial balance of $1,000,000, a final balance of $500,000, over a duration of 10 months:

Example 2: Calculate the burn rate and cash runway for a company with an initial balance of $800,000, a final balance of $600,000, over a duration of 5 months:

Q: What does a high burn rate indicate?

A: A high burn rate indicates rapid cash expenditure, which could lead to financial distress if not managed. It may signal the need to reduce costs, increase revenue, or secure additional funding.

Q: How can a company reduce its burn rate?

A: A company can reduce its burn rate by cutting unnecessary expenses, optimizing operations, renegotiating contracts, or increasing revenue through sales or investments.

Q: What is a good cash runway for a startup?

A: A good cash runway for a startup is typically 12–18 months, giving enough time to achieve milestones, secure funding, or become profitable. However, this varies based on the industry and business model.