Home

Home

Back

Back

Definition: This calculator computes the break-even point, which is the number of units a business needs to sell to cover its fixed costs, and the total sales revenue required to reach that point. At the break-even point, the business neither makes a profit nor incurs a loss.

Purpose: It is used by businesses to determine the minimum sales needed to avoid losses, helping with pricing strategies, cost management, and financial planning.

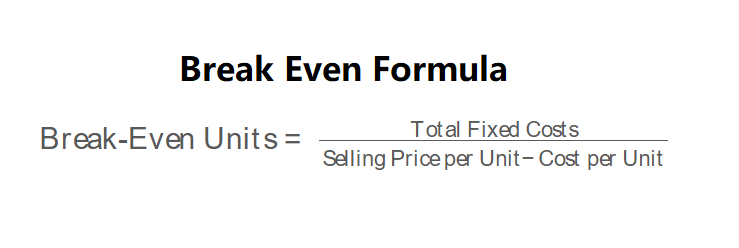

The calculator uses the break-even formulas, as shown in the image above:

\( \text{Break-Even Units} = \frac{\text{Total Fixed Costs}}{\text{Selling Price per Unit} - \text{Cost per Unit}} \)

\( \text{Break-Even Sales} = \text{Break-Even Units} \times \text{Selling Price per Unit} \)

Steps:

Calculating the break-even point is essential for:

Example 1: Calculate the break-even point for a business with a selling price of $45 per unit, a cost of $30 per unit, and total fixed costs of $2,700:

Example 2: Calculate the break-even point for a business with a selling price of $100 per unit, a cost of $60 per unit, and total fixed costs of $4,000:

Q: What does the break-even point represent?

A: The break-even point is the sales level at which a business covers all its fixed costs, resulting in zero profit or loss.

Q: Can the break-even point change?

A: Yes, changes in fixed costs, selling price, or cost per unit will affect the break-even point. For example, increasing fixed costs raises the break-even point, while increasing the selling price lowers it.

Q: How can a business lower its break-even point?

A: A business can lower its break-even point by reducing fixed costs, increasing the selling price, or decreasing the cost per unit to increase the profit per unit.