1. What is the Bond Yield to Maturity Calculator?

Definition: This calculator computes the yield to maturity (\( YTM \)), coupon payment per period (\( C_p \)), and annual coupon (\( C_a \)), representing the internal rate of return of a bond if held to maturity with coupons reinvested at the same rate.

Purpose: Helps investors evaluate the true annualized return of a bond based on its price, coupon payments, and time to maturity, aiding investment decisions.

2. How Does the Calculator Work?

The calculator follows a five-step process to compute the results:

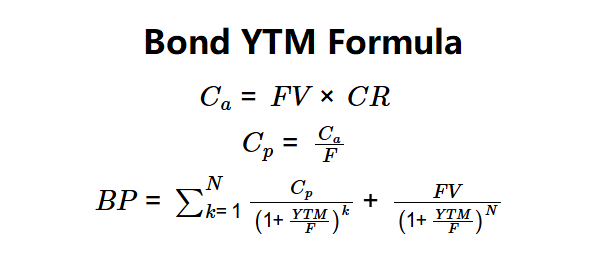

Formulas:

\( C_a = FV \times CR \)

\( C_p = \frac{C_a}{F} \)

The bond price is the sum of the present value of all coupon payments and the face value, discounted at the yield per period:

\( BP = \sum_{k=1}^{N} \frac{C_p}{\left(1 + \frac{YTM}{F}\right)^k} + \frac{FV}{\left(1 + \frac{YTM}{F}\right)^N} \)

The yield to maturity (\( YTM \)) is the rate that makes the above equation equal to the given bond price (\( BP \)).

Where:

- \( YTM \): Yield to Maturity (%)

- \( C_p \): Coupon Payment per Period (dollars)

- \( C_a \): Annual Coupon (dollars)

- \( BP \): Bond Price (dollars)

- \( FV \): Face Value (dollars)

- \( CR \): Annual Coupon Rate (decimal)

- \( F \): Coupon Frequency (per year)

- \( N \): Total Periods (\( Years \times F \))

Steps:

- Step 1: Determine face value. Use the bond’s principal at maturity (\( FV \)).

- Step 2: Determine bond price. Use the market price of the bond (\( BP \)).

- Step 3: Determine annual coupon rate and frequency. Calculate \( C_a = FV \times CR \) and \( C_p = \frac{C_a}{F} \).

- Step 4: Determine years to maturity. Use the number of years until the bond matures.

- Step 5: Calculate YTM. Find \( YTM \) that equates the bond price to the present value of future cash flows using numerical iteration.

3. Importance of Yield to Maturity Calculation

Calculating the YTM and related metrics is crucial for:

- Return Assessment: \( YTM \) provides the annualized return if the bond is held to maturity.

- Cash Flow Clarity: \( C_p \) and \( C_a \) quantify periodic and annual income, aiding financial planning.

- Investment Comparison: Allows comparison of bonds with different prices, coupons, and maturities.

4. Using the Calculator

Example (Bond A): \( FV = \$1,500 \), \( BP = \$1,350 \), \( CR = 6\% \), \( F = 1 \), Years = 15:

- Step 1: \( FV = \$1,500 \).

- Step 2: \( BP = \$1,350 \).

- Step 3:

- \( C_a = 1,500 \times 0.06 = \$90 \).

- \( C_p = \frac{90}{1} = \$90 \).

- Step 4: Years = 15.

- Step 5: Solve for \( YTM \) in \( 1,350 = \sum_{k=1}^{15} \frac{90}{(1 + YTM)^k} + \frac{1,500}{(1 + YTM)^{15}} \), yielding \( YTM = 7.11\% \).

- Results: \( C_p = \$90 \), \( C_a = \$90 \), \( YTM = 7.11\% \).

A YTM of 7.11% indicates a higher return than the coupon rate due to the bond’s discount price.

Example 2: \( FV = \$1,000 \), \( BP = \$1,050 \), \( CR = 5\% \), \( F = 2 \), Years = 10:

- Step 1: \( FV = \$1,000 \).

- Step 2: \( BP = \$1,050 \).

- Step 3:

- \( C_a = 1,000 \times 0.05 = \$50 \).

- \( C_p = \frac{50}{2} = \$25 \).

- Step 4: Years = 10.

- Step 5: Solve for \( YTM \) in \( 1,050 = \sum_{k=1}^{20} \frac{25}{(1 + \frac{YTM}{2})^k} + \frac{1,000}{(1 + \frac{YTM}{2})^{20}} \), yielding \( YTM \approx 4.54\% \).

- Results: \( C_p = \$25 \), \( C_a = \$50 \), \( YTM = 4.54\% \).

A YTM of 4.54% is lower than the coupon rate, reflecting the bond’s premium price.

Example 3: \( FV = \$2,000 \), \( BP = \$1,800 \), \( CR = 4\% \), \( F = 1 \), Years = 20:

- Step 1: \( FV = \$2,000 \).

- Step 2: \( BP = \$1,800 \).

- Step 3:

- \( C_a = 2,000 \times 0.04 = \$80 \).

- \( C_p = \frac{80}{1} = \$80 \).

- Step 4: Years = 20.

- Step 5: Solve for \( YTM \) in \( 1,800 = \sum_{k=1}^{20} \frac{80}{(1 + YTM)^k} + \frac{2,000}{(1 + YTM)^{20}} \), yielding \( YTM \approx 4.76\% \).

- Results: \( C_p = \$80 \), \( C_a = \$80 \), \( YTM = 4.76\% \).

A YTM of 4.76% indicates a higher return than the coupon rate due to the bond’s discount.

5. Frequently Asked Questions (FAQ)

Q: How does YTM differ from current yield?

A: YTM accounts for all cash flows (coupons and face value) and assumes reinvestment at the same rate, while current yield only considers annual coupons relative to price.

Q: Why include coupon per period and annual coupon?

A: \( C_p \) and \( C_a \) clarify the bond’s periodic and annual cash flows, essential for income planning, especially with non-annual frequencies.

Q: Can YTM be negative?

A: Yes, negative YTM can occur if the bond price significantly exceeds the sum of future cash flows, though this is rare and often reflects market distortions.

Bond Yield to Maturity Calculator© - All Rights Reserved 2025

Home

Home

Back

Back